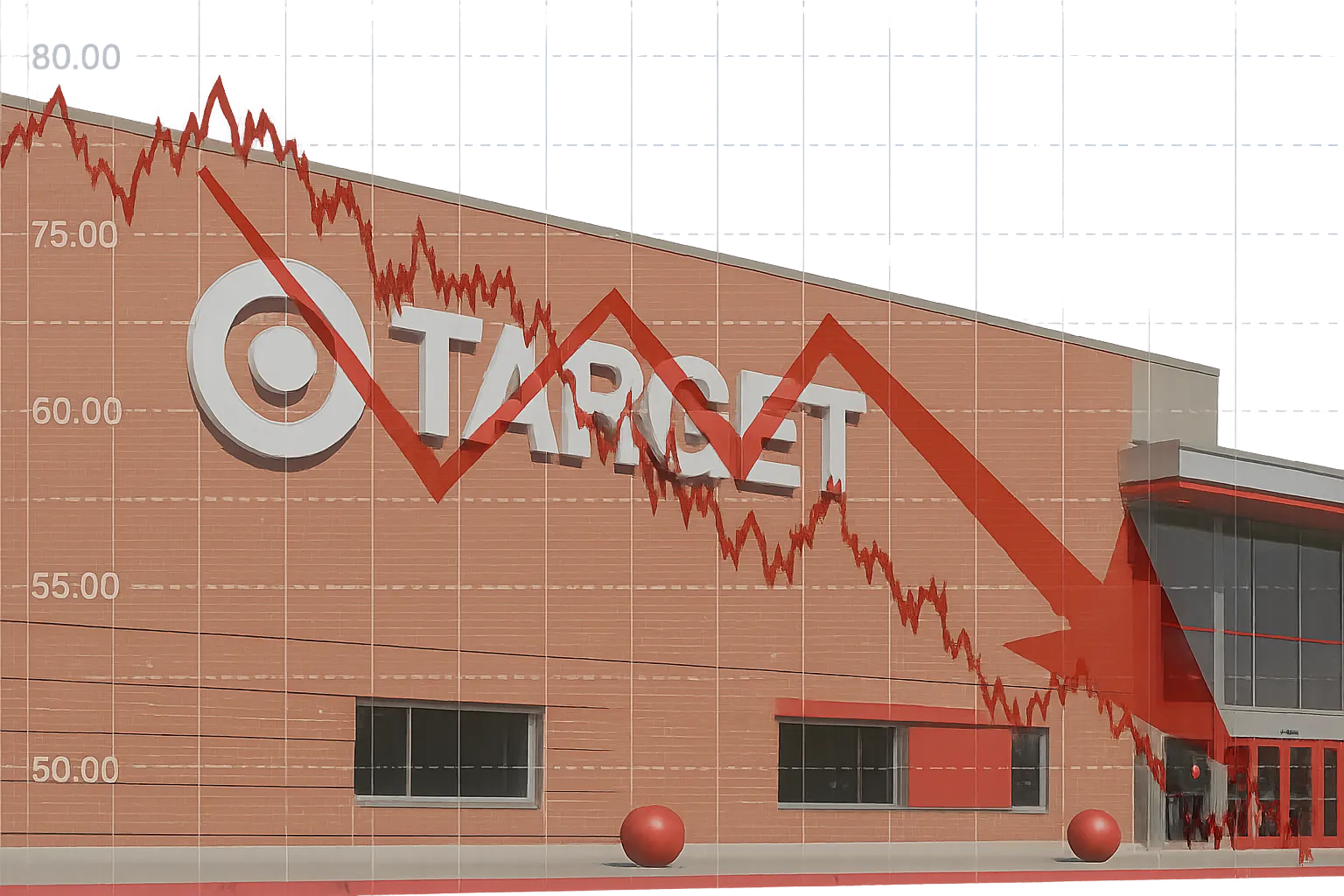

Target Stock Sinks Amid Leadership Change and Tepid Q2 Results

On August 20, 2025, Target Corporation’s shares (NYSE: TGT) dropped by 10.39% in pre-market trading. This decline was due to an internal CEO promotion and mixed results for the second quarter.

Target reported Q2 net sales of $25.21 billion. This is a 0.9% drop compared to last year. Diluted earnings per share were $2.05. This beat the consensus estimate of $2.01 but fell 20.2% from $2.57 a year ago. Comparable store sales declined 1.9%, though digital sales grew 4.3%. Margins narrowed to 29.0% from 30.0%, reflecting higher markdowns and canceled orders.

Investors had a strong reaction to the news. Michael Fiddelke, Target’s COO and a company veteran for 20 years, will become CEO on February 1, 2026. He is replacing Brian Cornell. Cornell, who led Target for ten years of growth and digital change, will take on the role of executive chair. Critics said the insider promotion didn’t tackle wider governance issues. They felt it also failed to show a new strategic direction.

““Our Q2 results slightly beat expectations, but we hear stakeholder concerns. We’re committed to improving Target’s position in a tough retail market,” Cornell said in a statement.

After the Q2 earnings release, Target stuck to its full-year outlook. It expects a small sales decline and GAAP EPS between $8.00 and $10.00. The stock sell-off showed that investors are worried. They are concerned about slow sales, pressure on margins, and stability in leadership.

Categories

Autos and vehicles Beauty and fashion Business and finance Climate Entertainment Food and drink Games Health Hobbies and leisure Jobs and education Law and government Other Politics Science Shopping Sports Technology Travel and transportationRecent Posts

Tags

Archives

08/19/2025 (3) 08/20/2025 (40) 08/21/2025 (27) 08/22/2025 (22) 08/23/2025 (4) 08/24/2025 (21) 08/25/2025 (30) 08/26/2025 (24) 08/27/2025 (29) 08/28/2025 (16) 08/29/2025 (9) 08/30/2025 (13) 08/31/2025 (17) 09/01/2025 (167) 09/02/2025 (124) 09/03/2025 (149) 09/04/2025 (112) 09/05/2025 (72) 09/06/2025 (169) 09/07/2025 (162) 09/08/2025 (150) 09/09/2025 (176) 09/10/2025 (194) 09/11/2025 (194) 09/12/2025 (186) 09/13/2025 (207) 09/14/2025 (159) 09/15/2025 (175) 09/16/2025 (198) 09/17/2025 (196) 09/18/2025 (196) 09/19/2025 (207) 09/20/2025 (129) 09/21/2025 (4)