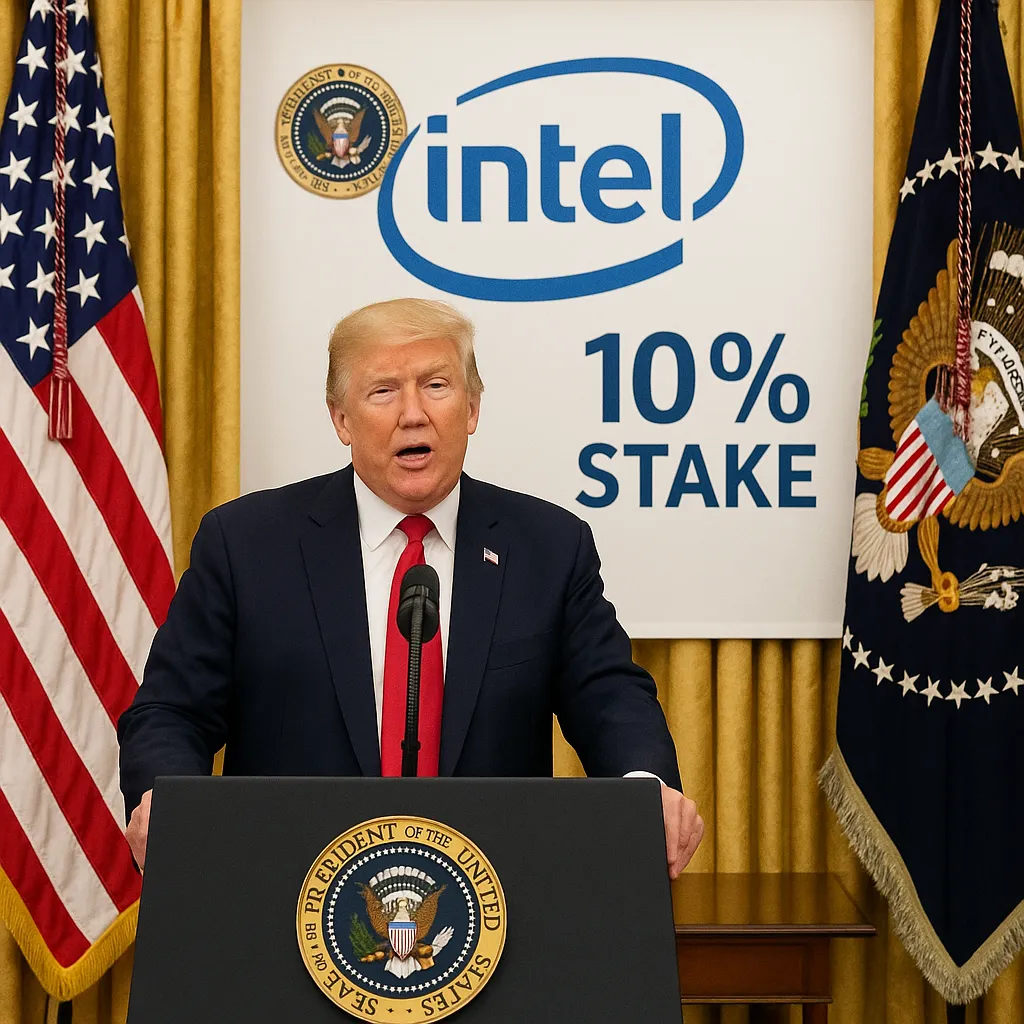

U.S. to Acquire 10% Stake in Intel

August 22, 2025 | Washington, D.C.

President Donald Trump announced today that the U.S. government will buy a 10 percent stake in Intel Corp. He called it “a great deal” for both sides.

Trump announced the deal at a press conference in the Oval Office. He said Intel CEO Lip-Bu Tan “agreed to do it.” This transaction brings $10 billion to federal funds while keeping all voting rights. After the announcement, Intel’s shares rose by 6 to 7 percent during midday trading.

The equity deal will turn grants that Intel received from the Biden-era CHIPS and Science Act into non-voting stock for the Treasury. This was stated by Commerce Secretary Howard Lutnick. Those incentives were meant to boost U.S. semiconductor capacity with almost $39 billion in subsidies. Now, Intel will give up governance control but gain stability for its foundry operations.

This intervention occurs while Intel is trying to recover under Tan. He became CEO in March after years of losing ground to AMD and Nvidia. The company reported an $18.8 billion deficit in 2024. It also cut its workforce by about 15 percent this year. Additionally, it has paused or delayed multibillion-dollar fab projects in Europe and Ohio.

This week, SoftBank Group from Japan announced a $2 billion investment in Intel. This shows more support from the private sector. Analysts think federal equity participation might be vital for Intel’s struggling foundry unit. But there are still doubts about the company’s product roadmap and its ability to bring in third-party clients.

Senator Bernie Sanders saw the deal as a great way to connect federal funding to public benefits. On the other hand, Senator Rand Paul called it a sign of government overreach. The White House is set to release formal documents later today. They will cover the transaction’s mechanics and timeline in detail.

- Ends -

Categories

Business and finance Climate Entertainment Food and drink Games Health Hobbies and leisure Jobs and education Law and government Other Politics Science Sports TechnologyRecent Posts

Tags