Nvidia Investors Brace Ahead of Q2 Earnings Report

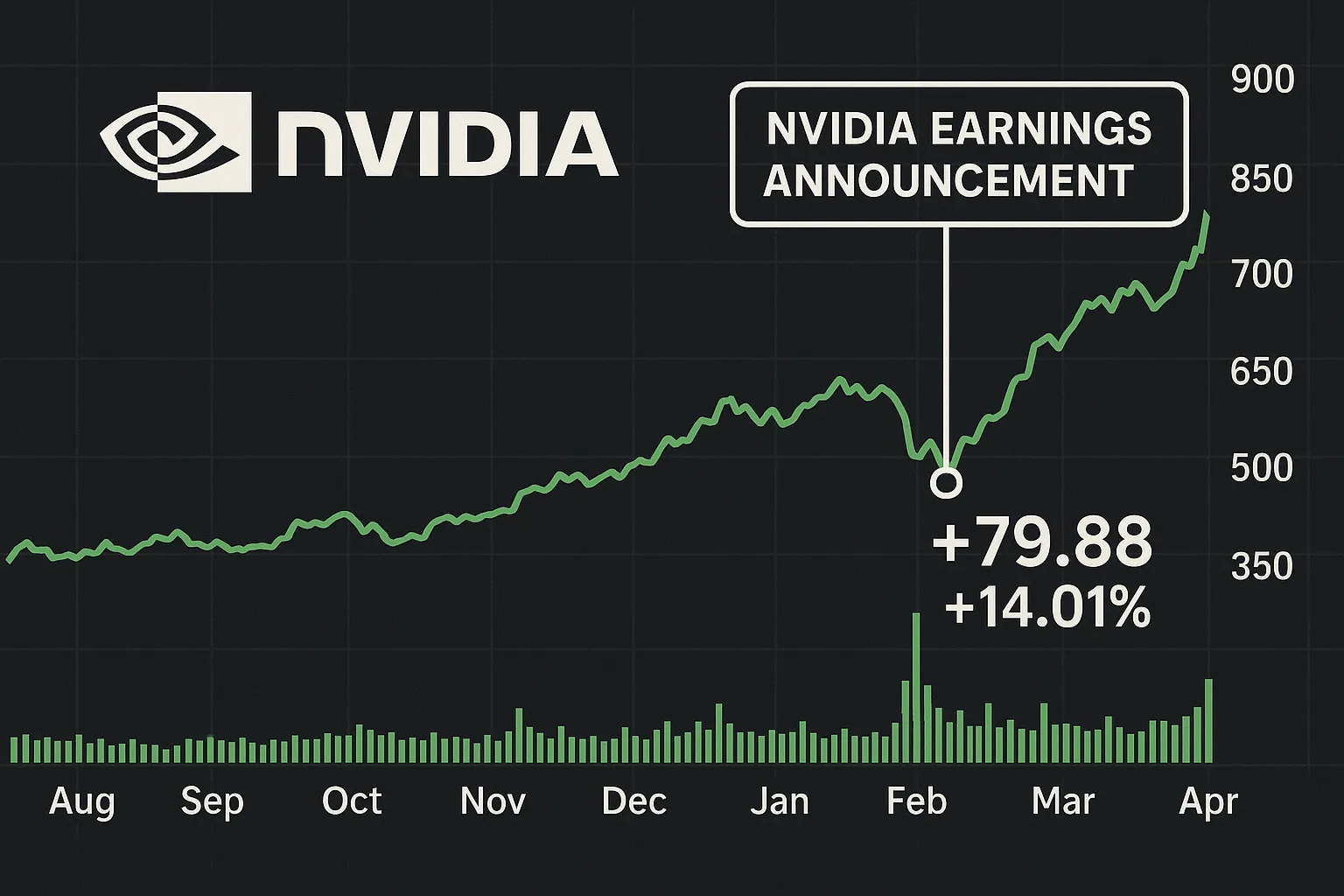

August 26, 2025 - Wall Street is on edge as Nvidia Corp. (NASDAQ: NVDA) approaches its fiscal second-quarter earnings announcement tomorrow, seeking clear signals on AI demand and China revenues.

In a report published today, analysts told investors to focus on three pivotal indicators: the pace of U.S.-China sales recovery, data-center growth trends, and management’s forward guidance on AI pricing and supply chain dynamics. Fiscal Q2 revenue is forecast at $46.05 billion, up 52% year-on-year, with earnings per share projected at $1.01, according to FactSet consensus estimates. Data-center revenue-accounting for the bulk of Nvidia’s sales-is expected to increase by 57% to $41.34 billion, though this marks a slowdown from the previous quarter’s 73% surge.

Investors are particularly attuned to Nvidia’s commentary on export restrictions. Last quarter’s requirement for U.S. government licensing of H20 chips led to a $4.5 billion charge and suspended shipments to China. Market participants will scrutinize whether management outlines a clear timeline for resuming those sales and how it plans to mitigate geopolitical headwinds.

Options markets signal heightened volatility, with implied moves of roughly ±6% post-earnings. Long-term holders remain upbeat on Nvidia’s technological edge-driven by its latest Blackwell GPUs-while tactical traders prepare for a possible “sell-the-news” reaction if guidance disappoints.

Nvidia will report its results after markets close Wednesday, followed by a conference call at 2:00 PM Pacific Time. Investors will look for granular segment breakdowns and any shifts in margin expectations as Nvidia navigates a complex AI landscape.

Categories

Beauty and fashion Business and finance Climate Entertainment Food and drink Games Health Hobbies and leisure Jobs and education Law and government Other Politics Science Shopping Sports Technology Travel and transportationRecent Posts

Tags