Hunter Nadeau, 23, was arrested Sunday after opening fire at a wedding reception at Sky Meadow Country Club in Nashua, New Hamp...

Thousands gather at State Farm Stadium in Glendale, Arizona, as President Donald Trump and Vice President J.D. Vance le...

Lead: The Justice Department has closed an FBI investigation into White House “border czar” Tom Homan’s allege...

Bad Bunny wrapped up his “No Me Quiero Ir de Aquí” residency in San Juan on September 20 with a globally streamed Amazon Music ...

Nashua, N.H. - A suspect was detained after a shooting at Sky Meadow Country Club on Saturday night left one p...

Bad Bunny streamed his final “No Me Quiero Ir de Aquí” residency concert live from San Juan’s Coliseo José Miguel Agrel...

Lead: The horror hit 28 Years Later launches on Netflix today, Sept. 20, delivering Danny Boyle and A...

Lead: A cyberattack on Collins Aerospace’s check-in and boarding systems disrupted operations at Brussels, Lon...

Liverpool secured a narrow 2-1 victory over Everton at Anfield today, while Crystal P...

Chelsea defender Tosin Adarabioyo was thrust into Premier League action at Old Trafford on Saturday, replacing forward Pedro Ne...

Superman, the blockbuster DC Studios film directed by James Gunn, makes its HBO linear debut tonight, September 20, at 8 p.m. E...

Lead: Skywatchers across the Southern Hemisphere are preparing for a partial solar eclipse on September 21-22,...

Lead Venus squares retrograde Uranus today, September 20, 2025, urging zodiac signs to assert individuality and embrace freedom...

Lead Terminal 2 at Dublin Airport was evacuated around 11:30 AM today after a suspicious luggage item prompted...

use rules: Structure and style of presentation News texts should be organized according to the “inverted pyramid” ...

University moves swiftly to terminate staff following criticism over social media comments mocking Charlie Kirk’s death...

Lead: Former WWE Superstar Braun Strowman revealed today that he will host a new USA Network culinary series a...

WASHINGTON, D.C., Sept. 20, 2025 - Homeland Security Secretary Kristi Noem today unveiled a nationwide “ICE In...

Today, Binance adjusted leverage and margin tiers for multiple USDⓈ-M perpetual futures contracts, impacting global tra...

Brighton & Hove Albion were held to a 2-2 draw by Tottenham Hotspur at the American Express Stadium on Saturday, with the v...

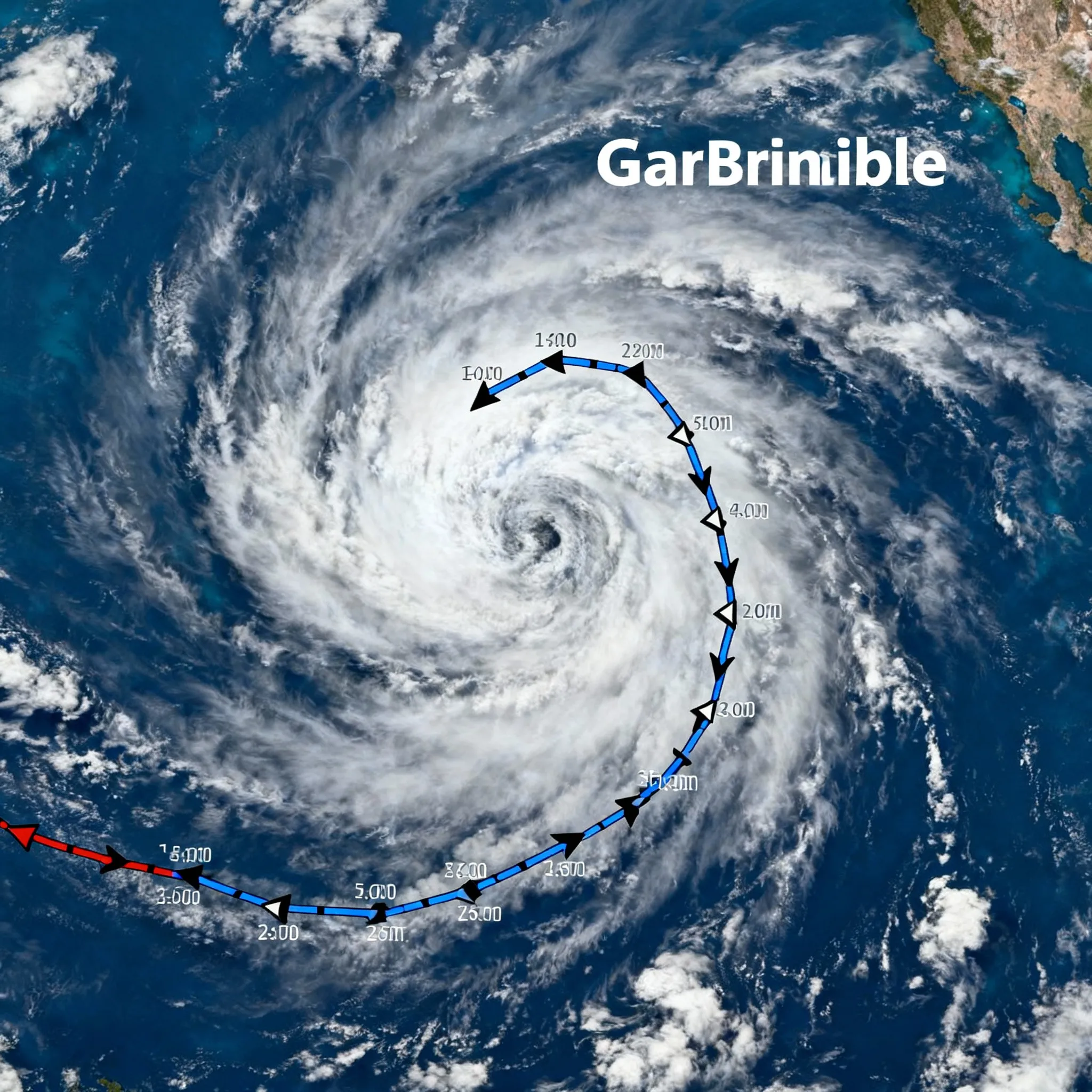

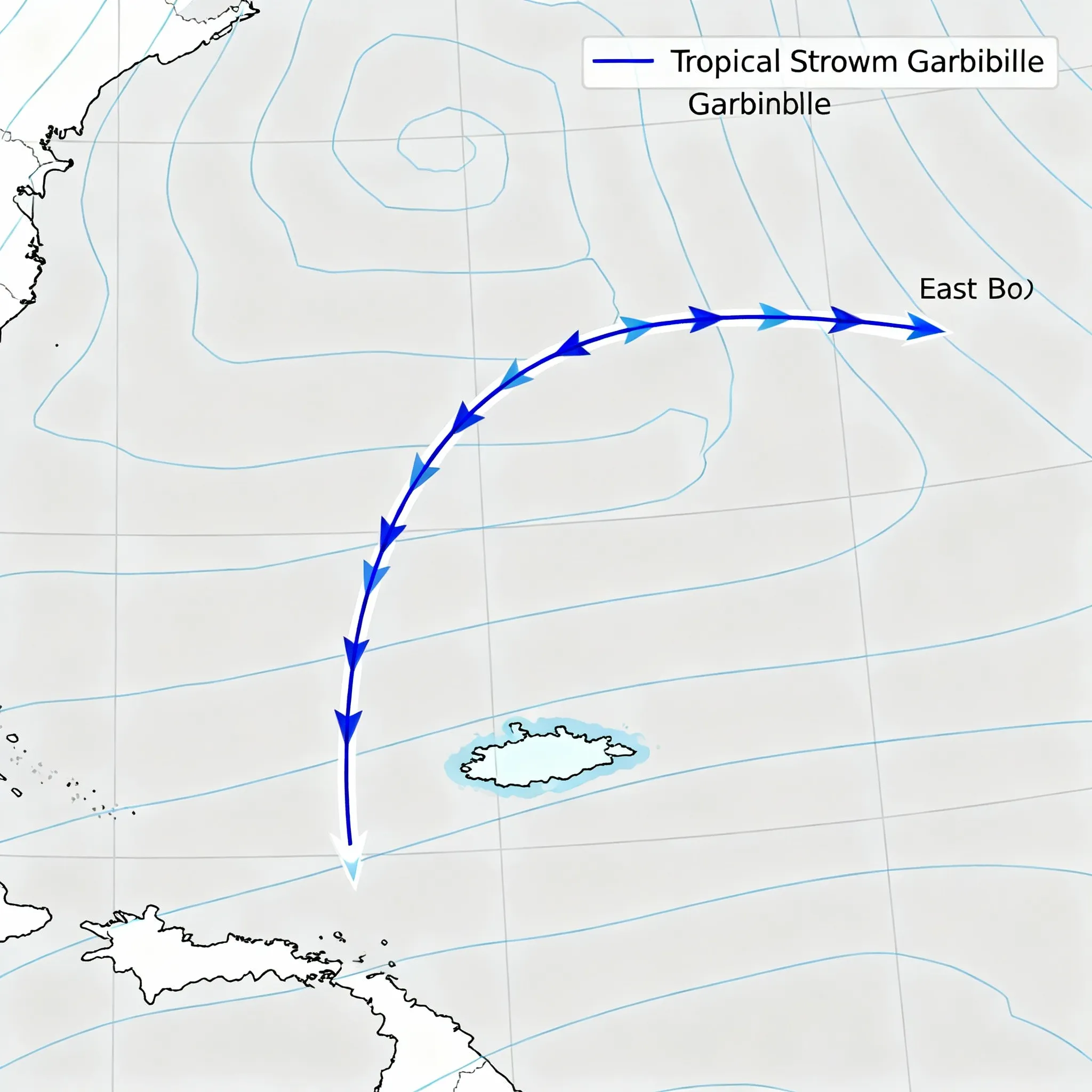

Tropical Storm Gabrielle intensified today in the central Atlantic, with sustained winds rising to 60 mph as it organizes under...

Lead A decades-old Johnny Carson “60 Minutes” segment warning against political preaching in entertainment resurfaced on social...

Metro runs free shuttle buses on Red Line segment due to weekend track work Today, Saturday, September ...

Lead: Today, September 20, 2025, saw no significant public announcements or appearances by model and entrepren...

BAKERSFIELD, Calif. - Sugar Ray rocked the Budweiser Pavilion and high-octane Monster Trucks revved through th...

Apple is poised to unveil a new generation of its Apple TV set-top box in the coming months, according to a Bloomberg report pu...

NEW YORK, Sept. 20, 2025 - Major cultural institutions and social-justice organizations across the United Stat...

Lead: In perfect running weather, 10,613 athletes launched the 51st BMW Berlin Marathon weekend with Saturday’...

Lead Madison experienced intermittent showers under partly sunny skies Saturday, with daytime highs reaching 73°F and overnight...

Lead A months-long manhunt for Travis Decker, the 32-year-old Army veteran accused of killing his three young daughters, likely...

Miami experienced warm temperatures and partly cloudy skies on Saturday, September 20, with g...

Lead: Supermodel and television host Heidi Klum kicked off Oktoberfest early by hosting her first-ever “HeidiF...

Lead Institutional investors Viking Fund Management and Miller Howard Investments added a combined 24,612 shares of Entergy Cor...

Katie Maloney’s offhand remark about her ex-husband Tom Schwartz’s proposal sparked an impromptu reaction from him on Instagram...

Lead: Actor Matthew McConaughey revealed that downsizing from a king-size to a queen-size bed has strengthened...

MARietta, GA (Sept. 20, 2025) - Thousands flocked to Jim R. Miller Park today as the North Georgia State Fair ...

Lead Oktoberfest Zinzinnati kicked off its third day on Saturday, Sept. 20, at Sawyer Point and Yeatman’s Cove in Cincinnati, d...

MINNEAPOLIS (Sept. 20) - Farm Aid celebrated its 40th anniversary today with a benefit concert at Huntington B...

Today, the 57th Annual Johnny Appleseed Festival opened in downtown Lisbon, Ohio, featuring a lively parade, pioneer-era demons...

BURBANK, CA (Sept. 20, 2025) - Fans around the globe marked Batman Day 2025 today with one-da...

Lead: Tropical Storm Gabrielle, centered about 530 mi northeast of the Leeward Islands, is moving northwestwar...

Lead Friday night’s Mega Millions drawing produced no jackpot winner, leaving the top prize at an estimated $451 million for th...

NEW YORK (September 20, 2025) - Conservative commentator Tomi Lahren officially joined Fox News Channel as one...

Maren Morris delivered a high-energy set as the marquee act at Sing Out Loud Festival’s Live Wildly Showcase in St. Augustine, ...

Lead U.S. military forces, acting on President Trump’s orders, conducted a “lethal kinetic strike” on a vessel in international...

Lead The New York Times released the Wordle solution for Saturday, September 20, 2025: DEFER, postponing today...

BOSTON - British diver Aidan Heslop and Australia’s Rhiannan Iffland clinched the King Kahekili trophies at the Red Bull Cliff ...

Lead: Astrologer Christopher Renstrom published his daily zodiac forecasts for September 20, 2025, across majo...

Lead: A cyberattack on the check-in and boarding software provider Collins Aerospace disrupted operations at H...

Lead: Dublin Airport’s Terminal 2 was evacuated Saturday after security scanners detected a suspicious item sh...

Categories

Autos and vehicles Beauty and fashion Business and finance Climate Entertainment Food and drink Games Health Hobbies and leisure Jobs and education Law and government Other Politics Science Shopping Sports Technology Travel and transportationRecent Posts

Tags

Archives

08/19/2025 (3) 08/20/2025 (40) 08/21/2025 (27) 08/22/2025 (22) 08/23/2025 (4) 08/24/2025 (21) 08/25/2025 (30) 08/26/2025 (24) 08/27/2025 (29) 08/28/2025 (16) 08/29/2025 (9) 08/30/2025 (13) 08/31/2025 (17) 09/01/2025 (167) 09/02/2025 (124) 09/03/2025 (149) 09/04/2025 (112) 09/05/2025 (72) 09/06/2025 (169) 09/07/2025 (162) 09/08/2025 (150) 09/09/2025 (176) 09/10/2025 (194) 09/11/2025 (194) 09/12/2025 (186) 09/13/2025 (207) 09/14/2025 (159) 09/15/2025 (175) 09/16/2025 (198) 09/17/2025 (196) 09/18/2025 (196) 09/19/2025 (207) 09/20/2025 (129) 09/21/2025 (4)