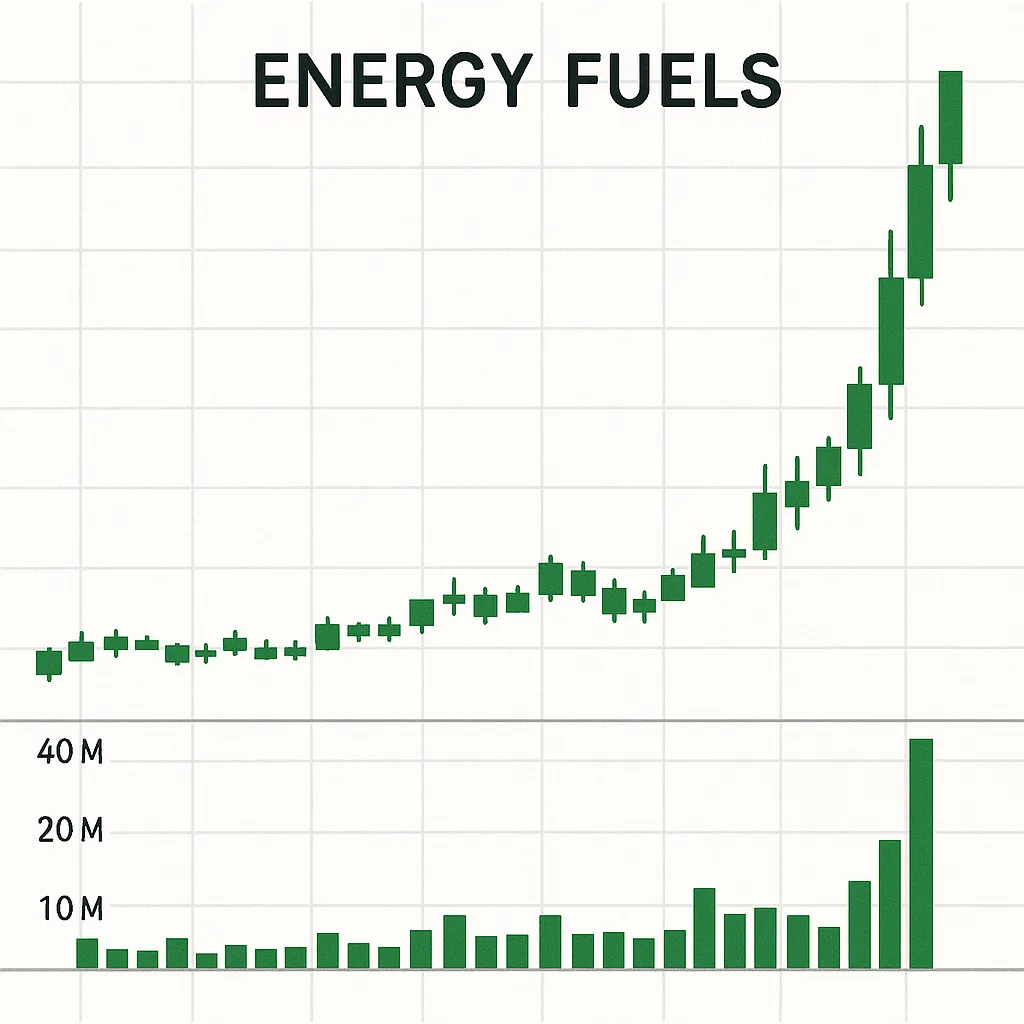

Energy Fuels Inc. (UUUU) Sees Volatile Rally on August 26, 2025

New York, NY (August 26, 2025) - Energy Fuels Inc. (NYSE American: UUUU) shares surged amid intense trading activity and bullish technical signals on Tuesday, marking another dramatic chapter in the uranium miner’s breakout story.

Early in the session, UUUU stock jumped as much as 12.7% to $12.32, briefly eclipsing its 52-week high of $12.58. Volume spiked to 7.4 million shares, representing over 3% of the company’s float, as algorithmic and momentum-driven buyers took control of the tape. With the stock trading above its 30-day moving average of $9.46 and the 200-day average of $5.85, technical momentum reached a fever pitch.

Options activity mirrored the equity move, with the August 29 $12.50 call option skyrocketing 540% in value and seeing the greatest open interest. Traders cited the narrowing bearish divergence in the MACD and the stock’s breach of Bollinger Bands’ upper threshold as signals of continued upward pressure, though some warned of potential short-term exhaustion given the rapid pace of gains.

Analysts point to several fundamental drivers underpinning UUUU’s rally. Unlike many peers, Energy Fuels is the only fully licensed and producing uranium miner in the United States, having raised its 2025 production guidance by 59% earlier this year. Its high-grade Pinyon Plain Mine in Arizona and newfound capability to produce 99.9% pure heavy rare earth oxides - a breakthrough that challenges China’s monopoly - add to its strategic appeal.

Cathie Wood’s Ark Invest has also highlighted nuclear power’s potential to surpass solar on a cost basis once utilization rates are factored in, further boosting interest in UUUU as a critical supplier of uranium and rare earth materials for AI data centers.

By mid-morning, sentiment reached new extremes on trading platforms, where UUUU was trending up 17.19% amid fresh excitement over its rare earth production milestones and regulatory approvals for key projects.

UUUU shares ultimately closed the day up approximately 10% as market participants weighed the sustainability of the parabolic move against ongoing national security initiatives aimed at reshoring critical mineral supply chains.

Investors are now watching the $12.58 level as immediate resistance and eyeing $11.42 as potential short-term support. A confirmed break above the recent high could open the door to retesting $15, while a pullback below the 30-day average may signal a pause in the rally.

Categories

Beauty and fashion Business and finance Climate Entertainment Food and drink Games Health Hobbies and leisure Jobs and education Law and government Other Politics Science Shopping Sports Technology Travel and transportationRecent Posts

Tags