Dow Jones Industrial Average Declines on Profit-Taking and Inflation Concerns

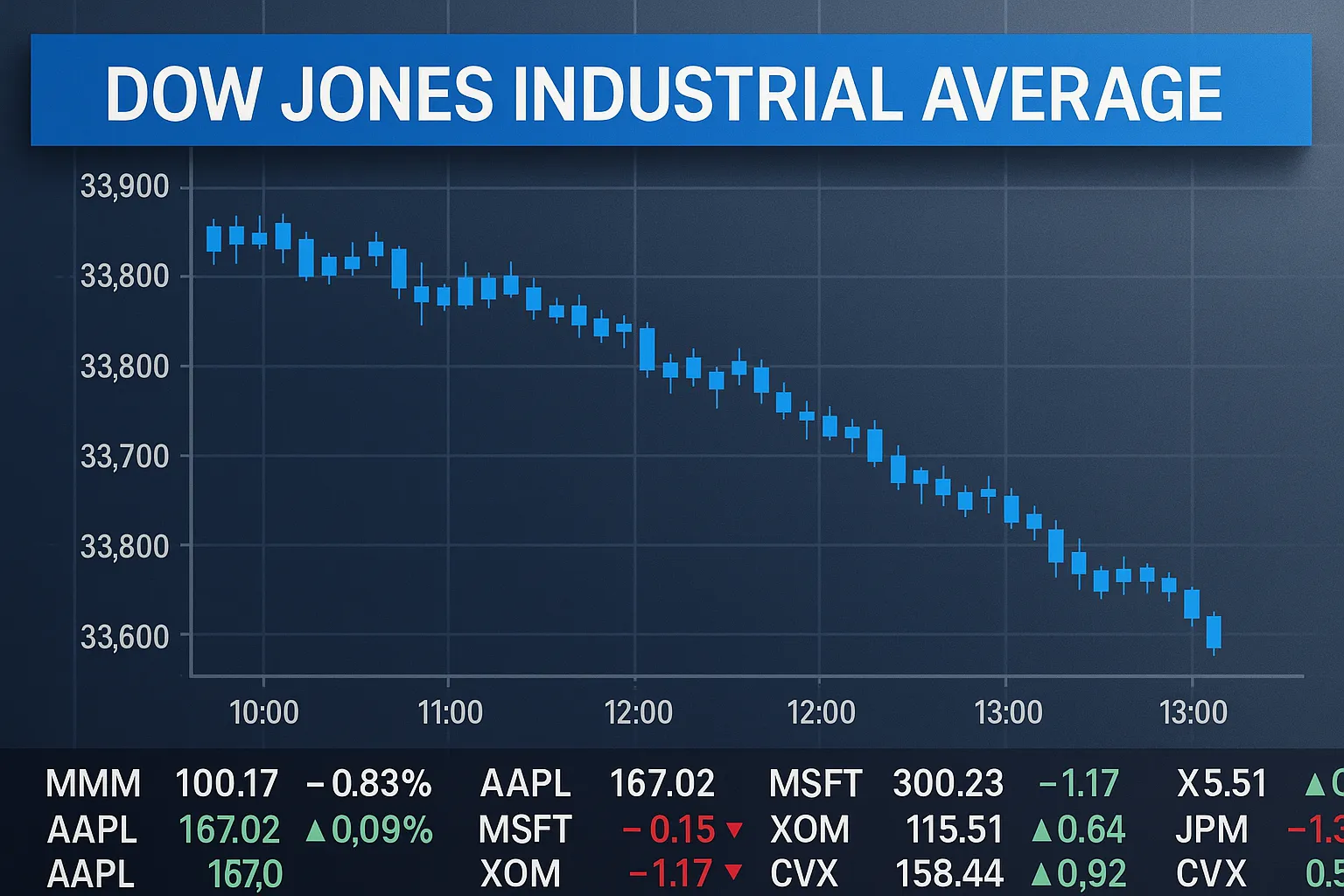

New York, September 2, 2025 (Reuters) - The Dow Jones Industrial Average slipped on Tuesday as investors booked profits in technology names and weighed persistent inflation data ahead of a key Federal Reserve policy meeting.

The blue-chip index closed down 0.2% at 45,544.88, off its intraday low by nearly 260 points and marking its first decline after three consecutive sessions of gains. Sixteen of the 30 components finished lower, led by heavyweight industrials and financials, while 14 ended higher.

U.S. stock futures had pointed to a further pullback after the Labor Day holiday, with Dow futures down 0.6% in early trading, as markets digested a federal appeals court ruling that cast doubt on the legality of many of President Trump’s tariffs.

Persistent inflation remained top of mind. The Commerce Department’s July personal consumption expenditure index rose 0.3% month-on-month and 2.6% year-on-year, both above consensus expectations, underscoring the Fed’s dilemma over the timing of its next rate move.

Global markets were mostly lower. In Europe, equities retreated as bond yields climbed to multi-year highs on both sides of the Atlantic. Gold held near record levels, trading above $3,550 an ounce, as investors sought safe havens amid trade-policy uncertainty and heightened market volatility.

Looking ahead, market participants will focus on this week’s U.S. ISM manufacturing survey and Friday’s nonfarm payrolls report for fresh clues on the Fed’s policy trajectory.

Categories

Autos and vehicles Beauty and fashion Business and finance Climate Entertainment Food and drink Games Health Hobbies and leisure Jobs and education Law and government Other Politics Science Shopping Sports Technology Travel and transportationRecent Posts

Tags

Archives

08/19/2025 (3) 08/20/2025 (40) 08/21/2025 (27) 08/22/2025 (22) 08/23/2025 (4) 08/24/2025 (21) 08/25/2025 (30) 08/26/2025 (24) 08/27/2025 (29) 08/28/2025 (16) 08/29/2025 (9) 08/30/2025 (13) 08/31/2025 (17) 09/01/2025 (167) 09/02/2025 (124) 09/03/2025 (149) 09/04/2025 (112) 09/05/2025 (72) 09/06/2025 (169) 09/07/2025 (162) 09/08/2025 (150) 09/09/2025 (176) 09/10/2025 (194) 09/11/2025 (194) 09/12/2025 (186) 09/13/2025 (207) 09/14/2025 (159) 09/15/2025 (175) 09/16/2025 (198) 09/17/2025 (196) 09/18/2025 (196) 09/19/2025 (207) 09/20/2025 (129) 09/21/2025 (4)