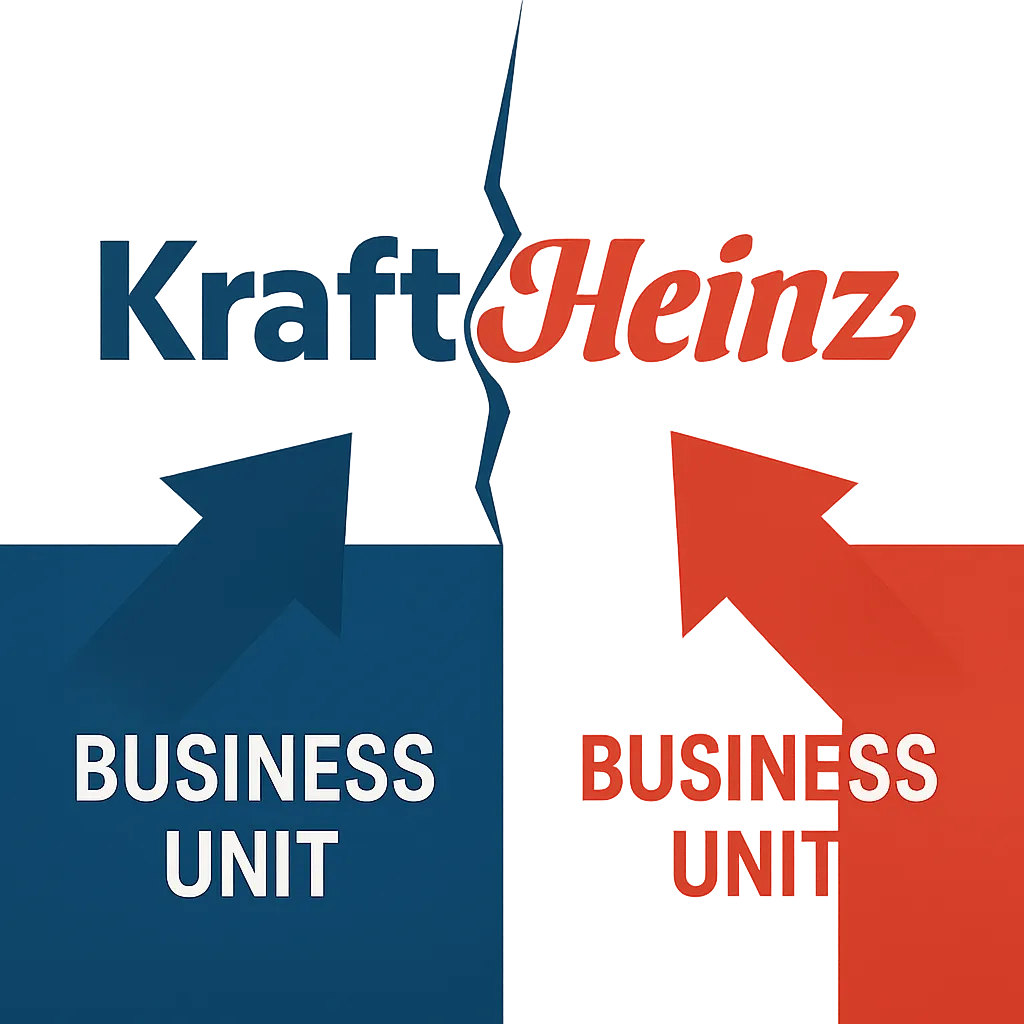

Kraft Heinz to Split into Two Companies

PITTSBURGH/CHICAGO, Sept. 2, 2025 - Kraft Heinz Co. announced today that it will separate into two independent, publicly traded companies, reversing the 2015 merger that created one of the world’s largest packaged-food conglomerates.

One of the newly formed businesses, provisionally dubbed Global Taste Elevation Co., will focus on sauces, spreads and shelf-stable meals-featuring iconic brands such as Heinz ketchup, Philadelphia cream cheese and Kraft Mac & Cheese. The second entity, tentatively named North American Grocery Co., will house grocery staples and food-service products, including Oscar Mayer meats, Kraft Singles and Lunchables.

The board of directors unanimously approved a tax-free spin-off structure, with the separation expected to close in the second half of 2026. Shares of Kraft Heinz ticked up slightly in early trading following the announcement.

Miguel Patricio, executive chair of Kraft Heinz, explained that the “complexities of our current structure” have hampered efficient capital allocation and brand-specific investment. He added that the split will “unleash the power of our brands and unlock the potential of our business” by allowing dedicated management teams to pursue tailored growth strategies.

Carlos Abrams-Rivera, chief executive officer of Kraft Heinz, will continue to lead North American Grocery Co. post-separation, while an executive search firm has been engaged to identify a CEO for Global Taste Elevation Co. During the transition period, the company will maintain unified operations under the Kraft Heinz umbrella to ensure business continuity.

The decision marks a strategic pivot after a decade of cost-cutting measures and mixed financial performance. Since the merger, Kraft Heinz has faced declining organic sales, mounting write-downs and pressure from shifting consumer preferences toward fresher and healthier options. In 2019, the company recorded a $15.4 billion impairment on its Oscar Mayer and Kraft brands, and its share price remains well below post-merger peaks.

Analysts note that the split follows a broader industry trend of breaking up large food conglomerates to improve operational focus and investor returns. Similar restructurings by Kellogg Co. and Keurig Dr Pepper underscore the challenges of managing diversified portfolios in an environment of evolving consumer tastes and cost inflation.

Categories

Autos and vehicles Beauty and fashion Business and finance Climate Entertainment Food and drink Games Health Hobbies and leisure Jobs and education Law and government Other Politics Science Shopping Sports Technology Travel and transportationRecent Posts

Tags