Mortgage Rates Dip as Fed Rate Cut Looms

Lead U.S. mortgage rates edged lower on Friday, September 5, 2025, with the average 30-year fixed rate falling to 6.48% and the 15-year fixed rate slipping to 5.65% amid expectations of an imminent Federal Reserve rate cut.

Nut Graf Borrowers are seizing on still-low rates-near 11-month lows-to lock in financing for home purchases and refinances before the Fed meets September 16-17. Despite mixed economic signals, the market anticipates a policy easing that could push rates even lower.

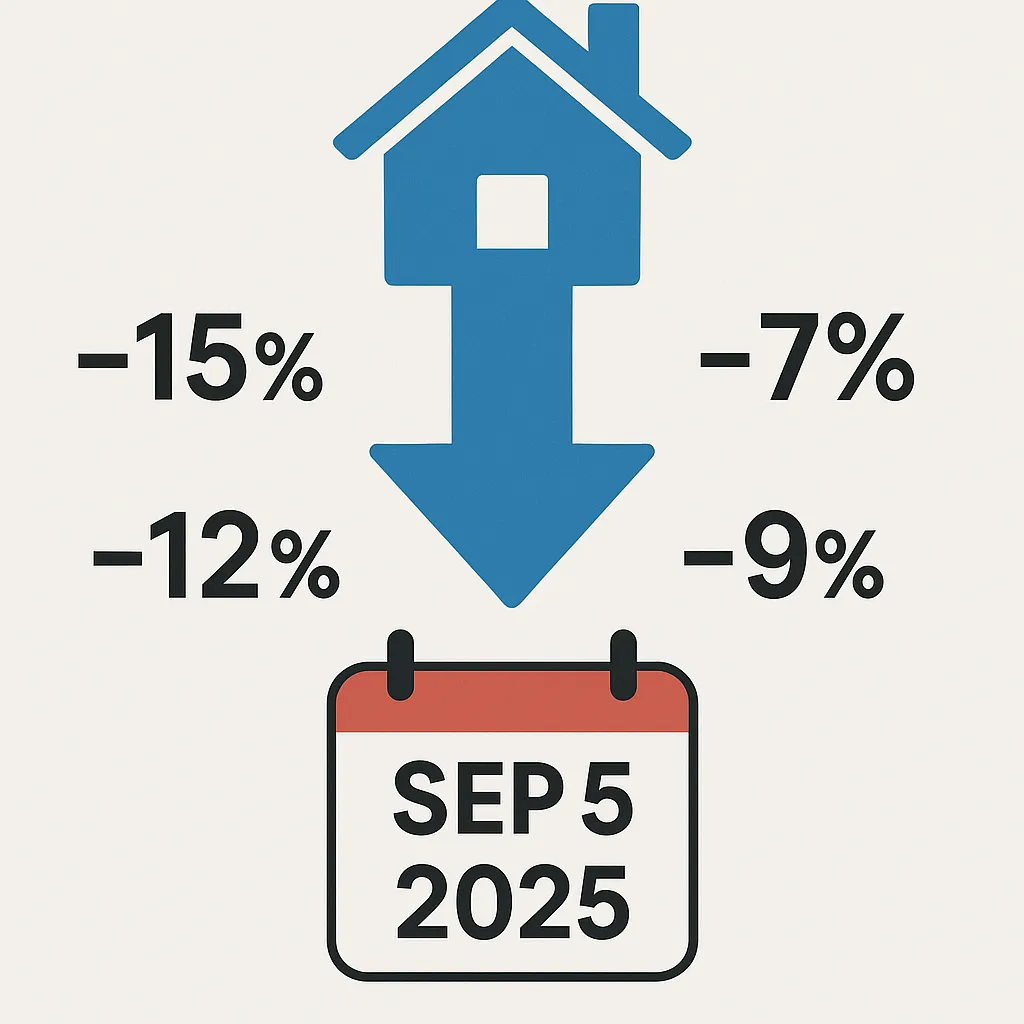

Current Rates

- 30-Year Fixed: 6.48% (down 0.06 percentage points from one week ago)

- 15-Year Fixed: 5.65% (down 0.04 percentage points)

- 5/1 ARM: 5.78% (down 0.04 percentage points)

- 30-Year Jumbo: 6.60% (down 0.02 percentage points)

Market Drivers The main driver of mortgage pricing remains the yield on 10-year Treasury notes, which held near 4.2% this week despite a hotter-than-expected Producer Price Index reading. Mixed August jobs data-just 22,000 positions added-have bolstered bets on a Fed rate cut and underpinned lower mortgage pricing.

Refinance Activity Refinance applications surged to nearly 47% of total mortgage applications, the highest level since October 2024, as homeowners seek to capitalize on the downtrend in rates and reduce monthly payments.

What’s Next With Fed Chair Jerome Powell hinting at an easing in mid-September, analysts forecast rates could dip below 6.4% on 30-year loans if inflation data due September 11 reinforces the case for cutting the federal funds rate. Borrowers are advised to compare offers, as variability among lenders remains moderate.

Categories

Autos and vehicles Beauty and fashion Business and finance Climate Entertainment Food and drink Games Health Hobbies and leisure Jobs and education Law and government Other Politics Science Shopping Sports Technology Travel and transportationRecent Posts

Tags

Archives

08/19/2025 (3) 08/20/2025 (40) 08/21/2025 (27) 08/22/2025 (22) 08/23/2025 (4) 08/24/2025 (21) 08/25/2025 (30) 08/26/2025 (24) 08/27/2025 (29) 08/28/2025 (16) 08/29/2025 (9) 08/30/2025 (13) 08/31/2025 (17) 09/01/2025 (167) 09/02/2025 (124) 09/03/2025 (149) 09/04/2025 (112) 09/05/2025 (72) 09/06/2025 (169) 09/07/2025 (162) 09/08/2025 (150) 09/09/2025 (176) 09/10/2025 (194) 09/11/2025 (194) 09/12/2025 (186) 09/13/2025 (207) 09/14/2025 (159) 09/15/2025 (175) 09/16/2025 (198) 09/17/2025 (196) 09/18/2025 (196) 09/19/2025 (207) 09/20/2025 (129) 09/21/2025 (4)