10-Year Treasury Yield Eases to 4.05% Ahead of Inflation Reports

Lead: On Monday in New York, the yield on the 10-year U.S. Treasury note fell to 4.05%, down 3 basis points from the prior session, as investors braced for key inflation data later this week.

Nut Graf: This modest pullback ends a brief three-day decline and underscores market caution ahead of Wednesday’s Producer Price Index and Thursday’s Consumer Price Index releases, which could sway expectations for Federal Reserve rate cuts.

Key Metrics

- Yield on 10-year note: 4.05% (-0.03 ppt)

- Previous session: 4.08%

- Month-to-date change: -0.24 ppt

- Year-over-year change: +0.35 ppt

Market Drivers

Investors have bid up bond prices-and driven yields lower-after August’s nonfarm payrolls report showed only 22,000 jobs added, well below forecasts. Dovish commentary from Fed officials and a slowing labor market have intensified speculation of a 25-basis-point cut at the Fed’s Sept. 16-17 meeting, with some traders even factoring in a half-point move.

Outlook for Inflation and Fed Policy

- Producer Price Index (PPI): Due Wednesday, with analysts watching for further evidence of easing price pressures.

- Consumer Price Index (CPI): Due Thursday; core CPI is forecast to rise 0.3% month-over-month, excluding food and energy.

- Fed rate bets: Markets have nearly priced in a quarter-point cut later this month, though a larger move remains possible if inflation cools faster than expected.

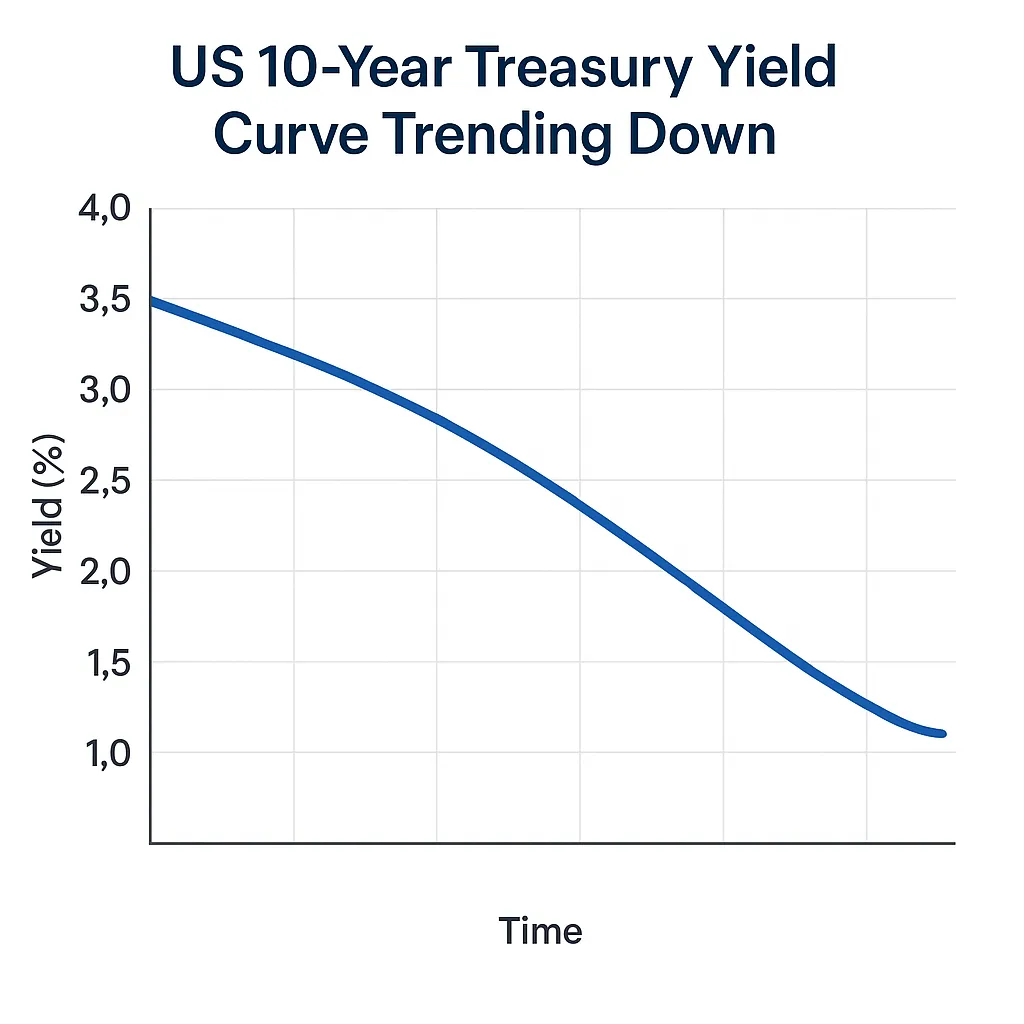

Broader Yield Curve Trends

While the 10-year yield steadied, short-term Treasury rates have also shifted on similar expectations. The spread between 10- and 2-year yields has rebounded, reflecting renewed confidence in an eventual Fed easing cycle.

Short, data-driven shifts in Treasury yields will continue to be monitored closely as the Federal Reserve prepares to decide on its next policy move later this month.

Categories

Autos and vehicles Beauty and fashion Business and finance Climate Entertainment Food and drink Games Health Hobbies and leisure Jobs and education Law and government Other Politics Science Shopping Sports Technology Travel and transportationRecent Posts

Tags

Archives

08/19/2025 (3) 08/20/2025 (40) 08/21/2025 (27) 08/22/2025 (22) 08/23/2025 (4) 08/24/2025 (21) 08/25/2025 (30) 08/26/2025 (24) 08/27/2025 (29) 08/28/2025 (16) 08/29/2025 (9) 08/30/2025 (13) 08/31/2025 (17) 09/01/2025 (167) 09/02/2025 (124) 09/03/2025 (149) 09/04/2025 (112) 09/05/2025 (72) 09/06/2025 (169) 09/07/2025 (162) 09/08/2025 (150) 09/09/2025 (176) 09/10/2025 (194) 09/11/2025 (194) 09/12/2025 (186) 09/13/2025 (207) 09/14/2025 (159) 09/15/2025 (175) 09/16/2025 (198) 09/17/2025 (196) 09/18/2025 (196) 09/19/2025 (207) 09/20/2025 (129) 09/21/2025 (4)