BlackRock Uncovers Widening Retirement Confidence Gap in New York Survey

Lead BlackRock’s tenth annual “Read on Retirement” report, released today in New York, reveals a record-low employer confidence despite soaring saver optimism, underscoring urgent demand for better planning solutions.

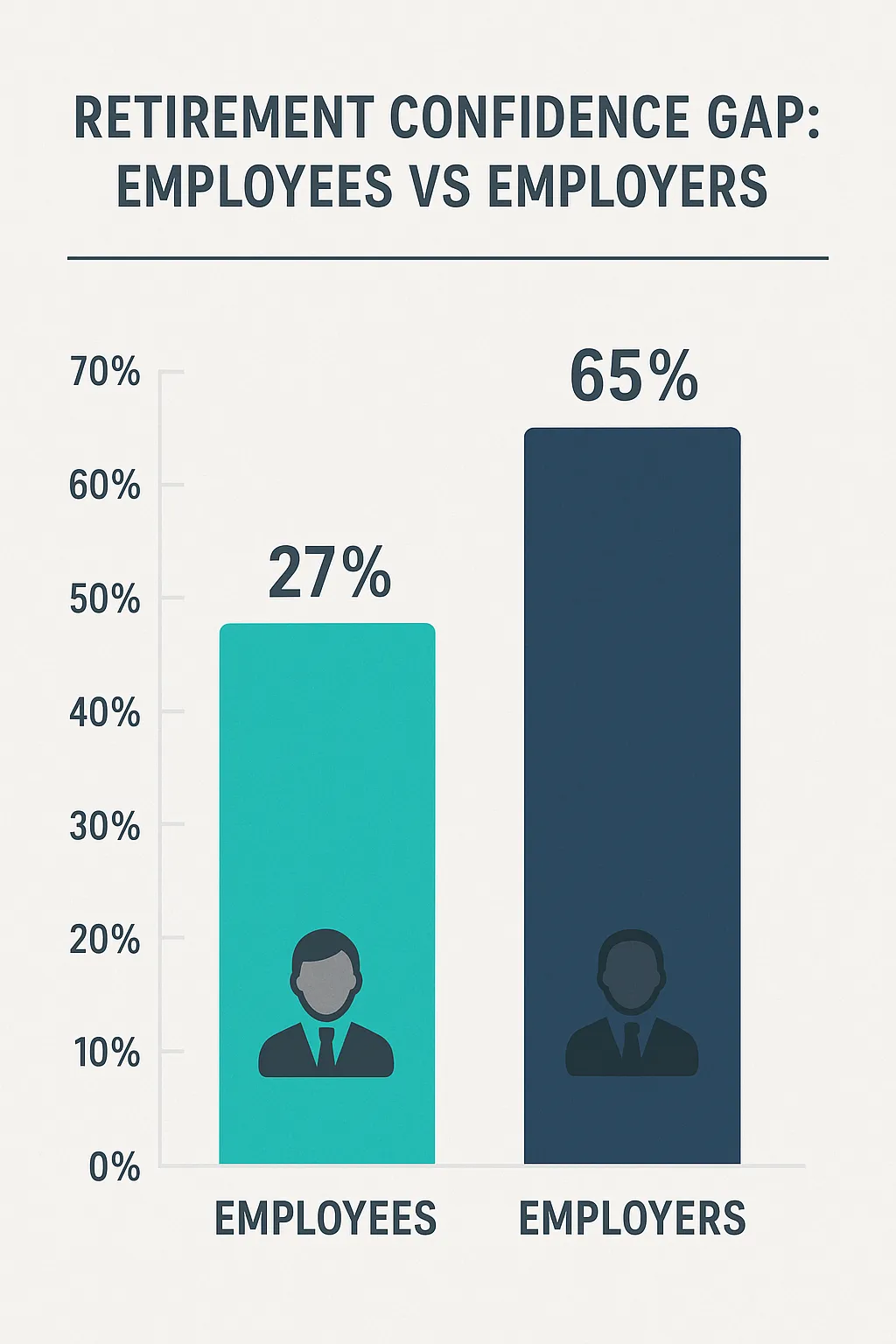

Nut Graf The landmark study highlights a striking disparity: 64% of workplace savers feel on track for retirement, yet only 38% of plan sponsors share that view. This disconnect signals growing risks of shortfalls and amplifies calls for enhanced education and guaranteed-income products.

Survey Highlights

- Savers’ confidence climbs - Two-thirds of employees report feeling prepared for retirement, up 23% over the past decade.

- Employer skepticism peaks - Just 38% of plan sponsors believe their workforce is adequately saving, marking a historic low.

- Retiree readiness plunges - Only 27% of retirees feel financially secure for the duration of retirement, down sharply from 43% in 2020.

Demographic Disparities Generation X, closest to retirement, trails with only 54% feeling on track, while 76% of Generation Z express confidence despite student-loan burdens. This split reveals age-specific challenges requiring targeted outreach.

Bridging the Gap Employers and savers alike are eyeing professional guidance and guaranteed-income solutions. BlackRock notes a surge in interest for actively managed target-date funds and private-market allocations as tools to narrow the readiness divide.

Looking Ahead With economic uncertainties dampening savings rates-median contributions fell from 12% in 2022 to 10% in 2025-experts urge plan sponsors to bolster financial literacy initiatives and diversify plan offerings to safeguard futures.

Categories

Autos and vehicles Beauty and fashion Business and finance Climate Entertainment Food and drink Games Health Hobbies and leisure Jobs and education Law and government Other Politics Science Shopping Sports Technology Travel and transportationRecent Posts

Tags

Archives

08/19/2025 (3) 08/20/2025 (40) 08/21/2025 (27) 08/22/2025 (22) 08/23/2025 (4) 08/24/2025 (21) 08/25/2025 (30) 08/26/2025 (24) 08/27/2025 (29) 08/28/2025 (16) 08/29/2025 (9) 08/30/2025 (13) 08/31/2025 (17) 09/01/2025 (167) 09/02/2025 (124) 09/03/2025 (149) 09/04/2025 (112) 09/05/2025 (72) 09/06/2025 (169) 09/07/2025 (162) 09/08/2025 (150) 09/09/2025 (176) 09/10/2025 (194) 09/11/2025 (194) 09/12/2025 (186) 09/13/2025 (207) 09/14/2025 (159) 09/15/2025 (175) 09/16/2025 (198) 09/17/2025 (196) 09/18/2025 (196) 09/19/2025 (207) 09/20/2025 (129) 09/21/2025 (4)