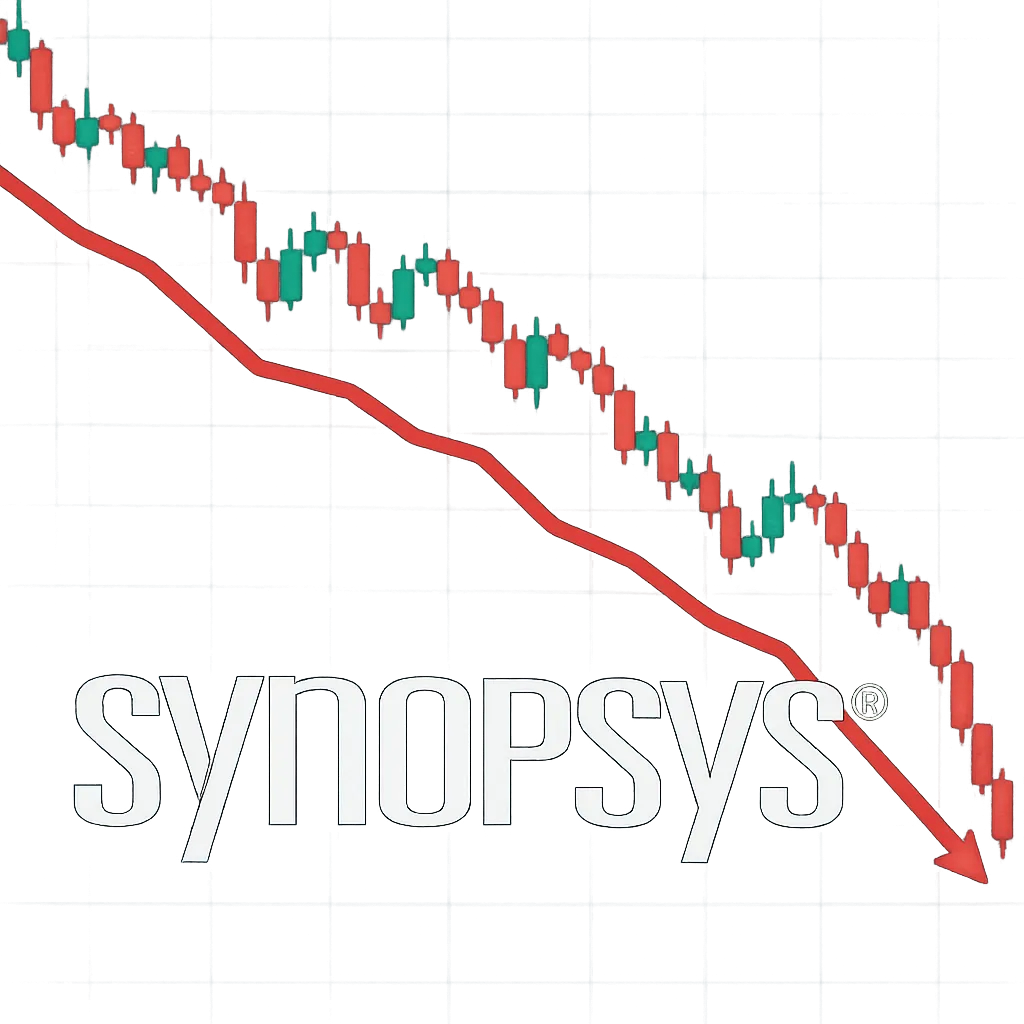

Synopsys Shares Plunge 34% After Q3 Miss and Weak IP Outlook

Lead: Synopsys (NASDAQ: SNPS) shares collapsed 34% to close at $398.40 in Wednesday trading after the EDA firm missed fiscal Q3 estimates and cut full-year profit guidance following underperformance in its Design IP business

.

Nut Graf: The steep decline reflects investor concern over weaker-than-expected third-quarter earnings-driven by export restrictions and a key foundry setback in its IP segment-as well as a cautious outlook that trimmed revenue and EPS forecasts for Q4 and fiscal 2025.

Q3 Results Drive Sell-Off

- Third-quarter revenue totaled $1.74 billion, below Wall Street’s $1.77 billion consensus, while non-GAAP EPS came in at $3.39 versus the $3.74 estimate.

- The stock opened at $611.97 on Wednesday, dipped to a low of $390.20, and ended the session down 34.1% at $398.40.

- Trading volume surged to 5.86 million shares, more than double the prior day’s activity.

Export Curbs Hit IP Segment

- Synopsys’ Design IP division revenue fell 8% year-over-year to $428 million amid new U.S. export restrictions on chip-design tools for China and a cancelled deal with a major foundry client.

- CEO Sassine Ghazi noted that export hurdles and integration costs from the July Ansys acquisition weighed on IP performance, prompting a strategic resource reallocation.

Guidance Slashed

- For Q4, Synopsys now forecasts revenue of $2.23 billion-$2.26 billion and non-GAAP EPS of $2.76-$2.80, well below analyst projections of $2.09 billion and $4.61 respectively.

- Fiscal 2025 revenue guidance was lowered to a range of $7.03 billion-$7.06 billion, with EPS guidance trimmed to $12.76-$12.80 from the prior $15.11-$15.19 outlook.

Cost Cuts Ahead

- Management announced plans to reduce global headcount by approximately 10% through fiscal 2026 to improve operational efficiency and offset integration expenses.

Categories

Autos and vehicles Beauty and fashion Business and finance Climate Entertainment Food and drink Games Health Hobbies and leisure Jobs and education Law and government Other Politics Science Shopping Sports Technology Travel and transportationRecent Posts

Gunman Arrested After Country Club Wedding Shooting in Nashua

Trump, Vance Honor Charlie Kirk at Massive Arizona Funeral

DOJ Closes Bribery Probe into Border Czar Tom Homan

Bad Bunny Concludes Puerto Rico Residency with Star-Studded Amazon Livestream

Multiple Shot, Including One Fatality, at Sky Meadow Country Club

Bad Bunny Delivers Historic “Una Más” Livestream Finale from Puerto Rico

‘28 Years Later’ Arrives on Netflix, Three Months After Theatrical Debut

Cyberattack Snarls Check-In Systems at Major European Airports

Premier League Sees Upsets as Liverpool Edges Everton

Chelsea’s Adarabioyo Drafted In After Sanchez Sent Off at Old Trafford

Superman Premieres on HBO Linear Tonight as Streaming Hit

Southern Skies to Darken: Partial Solar Eclipse Looms Tomorrow

Venus’s Square with Uranus Fuels Independence in Today’s Horoscopes

Dublin Airport’s Terminal 2 Evacuated and Reopened After Security Alert

Tell me what happened today 09/20/2025: “tcu” and write it in news format in English.

Clemson University Dismisses Three Employees After Free Speech Controversy

Braun Strowman Unveils USA Network Series and Horror Sequel Role

Noem Launches National ICE Initiative via Social Media

Binance Implements Margin and Leverage Adjustments on September 20, 2025

Spurs Salvage Late Draw at Brighton

Tags

Archives

08/19/2025 (3) 08/20/2025 (40) 08/21/2025 (27) 08/22/2025 (22) 08/23/2025 (4) 08/24/2025 (21) 08/25/2025 (30) 08/26/2025 (24) 08/27/2025 (29) 08/28/2025 (16) 08/29/2025 (9) 08/30/2025 (13) 08/31/2025 (17) 09/01/2025 (167) 09/02/2025 (124) 09/03/2025 (149) 09/04/2025 (112) 09/05/2025 (72) 09/06/2025 (169) 09/07/2025 (162) 09/08/2025 (150) 09/09/2025 (176) 09/10/2025 (194) 09/11/2025 (194) 09/12/2025 (186) 09/13/2025 (207) 09/14/2025 (159) 09/15/2025 (175) 09/16/2025 (198) 09/17/2025 (196) 09/18/2025 (196) 09/19/2025 (207) 09/20/2025 (129) 09/21/2025 (4)