Markets Price In Fed Rate Cut as Dollar Slumps to Multi-Month Lows

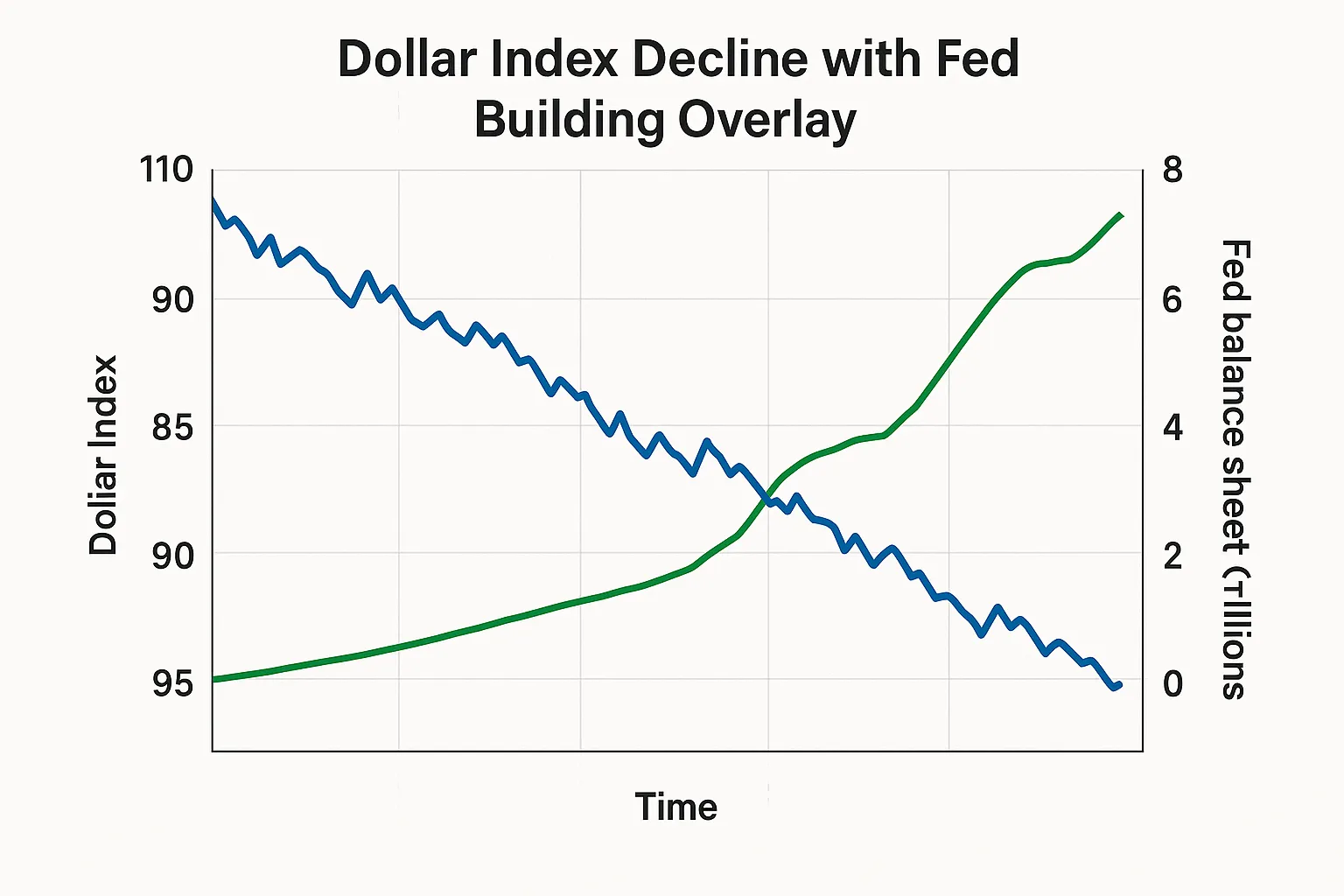

Lead: The U.S. dollar slid to two-month troughs against major peers as investors ramped up bets on a Federal Reserve interest-rate cut at its policy meeting starting Tuesday in Washington.

Nut Graf: With economic data pointing to a cooling labor market and persistently above-target inflation, traders see a 25-basis-point reduction as almost certain, shifting positions into longer-term debt and weighing on the greenback’s near-term outlook.

Fed Meeting Kicks Off Amid Heightened Cut Expectations

Investors are fully pricing in a quarter-point rate cut when the Federal Open Market Committee concludes on Wednesday, with only a slim chance of a larger move. President Donald Trump’s calls for deeper easing have intensified scrutiny on Fed Chair Jerome Powell’s language at the post-meeting press conference.

Dollar Index Hits Lowest Since July

- The U.S. dollar index fell to 97.044, its weakest level since July 7, reflecting broad-based declines against the euro, sterling and the Australian dollar.

- Market positioning has grown cautious, with traders largely sidelined until the Fed’s decision materializes.

Bond Investors Hunt Longer Maturities

Anticipation of rate cuts has driven bond investors into longer-dated securities.

- Demand for 10-year Treasuries surged as traders bet on a steeper yield curve post-cut.

- Steeper curves typically signal future easing, aligning with the Fed’s potential pivot.

Upcoming Data to Shape Fed Guidance

Attention now turns to U.S. retail sales and import/export price figures due Tuesday, alongside Wednesday’s August consumer price index, as policymakers weigh fresh evidence on inflation pressures.

Global Rate Landscape

- The European Central Bank left its key rates unchanged at 2.15% on Sept. 11, maintaining a wait-and-see approach amid steady inflation in the eurozone.

- The Bank of England is not expected to alter its 4% benchmark on Thursday, with policymakers closely monitoring domestic inflation and growth dynamics.

Categories

Autos and vehicles Beauty and fashion Business and finance Climate Entertainment Food and drink Games Health Hobbies and leisure Jobs and education Law and government Other Politics Science Shopping Sports Technology Travel and transportationRecent Posts

Tags

Archives

08/19/2025 (3) 08/20/2025 (40) 08/21/2025 (27) 08/22/2025 (22) 08/23/2025 (4) 08/24/2025 (21) 08/25/2025 (30) 08/26/2025 (24) 08/27/2025 (29) 08/28/2025 (16) 08/29/2025 (9) 08/30/2025 (13) 08/31/2025 (17) 09/01/2025 (167) 09/02/2025 (124) 09/03/2025 (149) 09/04/2025 (112) 09/05/2025 (72) 09/06/2025 (169) 09/07/2025 (162) 09/08/2025 (150) 09/09/2025 (176) 09/10/2025 (194) 09/11/2025 (194) 09/12/2025 (186) 09/13/2025 (207) 09/14/2025 (159) 09/15/2025 (175) 09/16/2025 (198) 09/17/2025 (196) 09/18/2025 (196) 09/19/2025 (207) 09/20/2025 (129) 09/21/2025 (4)