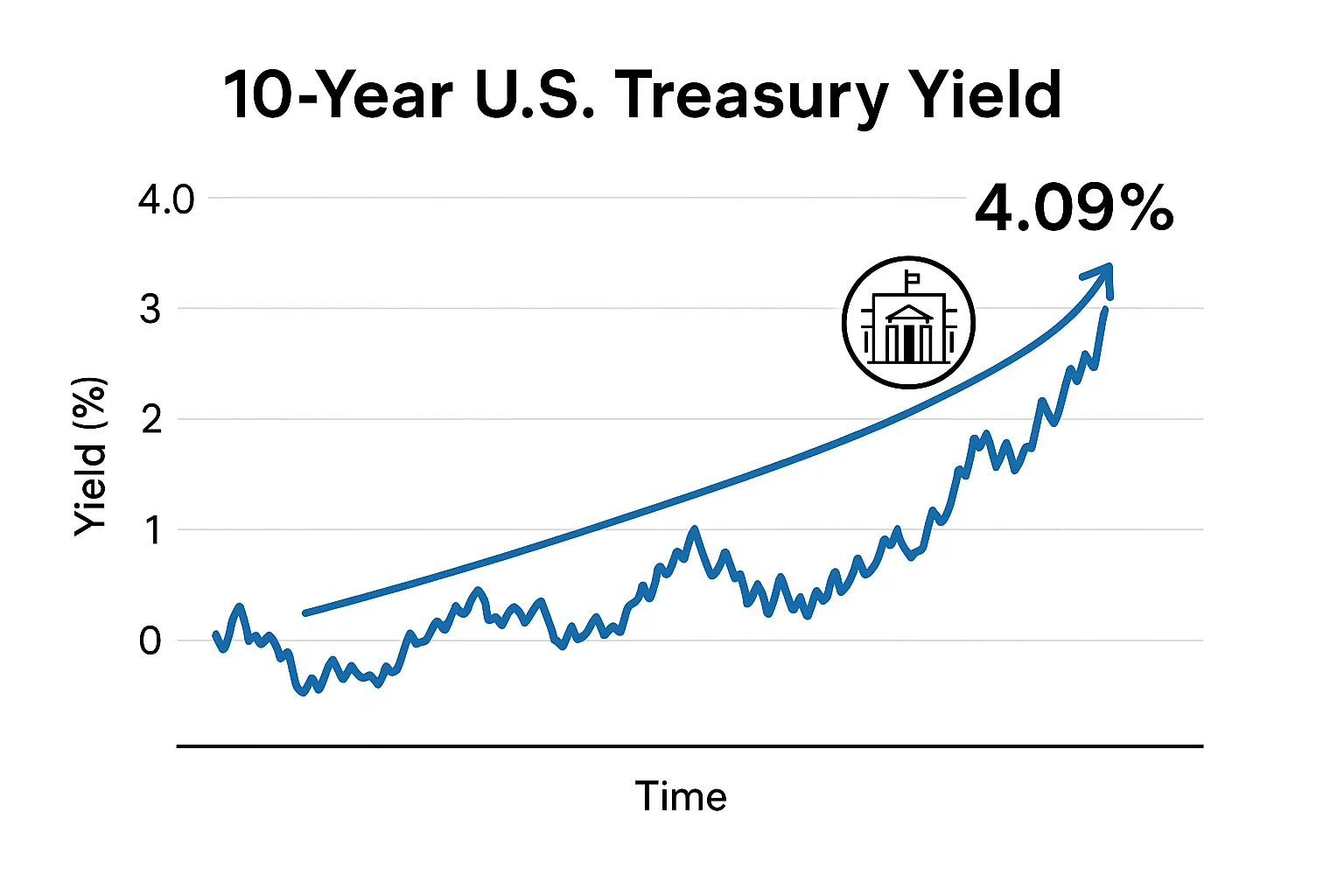

10-Year Treasury Yield Climbs to 4.09% on Fed Rate Outlook

Lead The yield on the 10-year U.S. Treasury note rose to 4.09% in early Wednesday trading, up 6 basis points as investors weighed the Federal Reserve’s latest rate cut and forward guidance.

Nut Graf After the Fed trimmed its benchmark rate by 25 basis points to a 4.00-4.25% range, markets briefly pushed 10-year yields below 4.00%, but Chairman Powell’s cautious remarks on further easing spurred a rebound. The move underscores persistent inflation concerns and mixed signals on economic growth and labor markets.

Main Part

Subheading: Fed Decision and Market Reaction

- At 2:00 p.m. EDT, the FOMC announced its first quarter-point rate cut since December, signaling two more cuts this year but emphasizing uncertainty over inflation’s trajectory.

- In post-meeting comments, Powell stressed that the reduction did not commit the Fed to a steeper easing path, citing resilient consumer spending and sticky core inflation.

Subheading: Yield Curve Dynamics

- The 10-year yield climbed from a session low near 3.99%, closing at 4.09%, marking a monthly drop of 25 basis points despite the intraday uptick.

- Shorter maturities saw sharper declines: the 2-year note rose 6 bps to 3.57%, steepening the 10-2 curve by 0.53 percentage points.

Subheading: Economic Indicators in Focus

- September retail sales data and weekly jobless claims later this week may further sway Treasury demand as markets assess growth momentum.

- Fed’s quarterly Summary of Economic Projections, due today, will reveal updated rate forecasts via the dot-plot.

Subheading: Investor Implications

- Higher long-term yields boost borrowing costs for mortgages and corporate debt, while savers have gained from elevated yields on bank products.

- Bond investors remain split between anticipating sustained Fed easing and guarding against persistent inflation risks.

The yield rebound highlights market sensitivity to Fed communications even after policy easing, reinforcing the complex interplay between economic data, central bank guidance, and Treasury market dynamics.

Categories

Autos and vehicles Beauty and fashion Business and finance Climate Entertainment Food and drink Games Health Hobbies and leisure Jobs and education Law and government Other Politics Science Shopping Sports Technology Travel and transportationRecent Posts

Tags

Archives

08/19/2025 (3) 08/20/2025 (40) 08/21/2025 (27) 08/22/2025 (22) 08/23/2025 (4) 08/24/2025 (21) 08/25/2025 (30) 08/26/2025 (24) 08/27/2025 (29) 08/28/2025 (16) 08/29/2025 (9) 08/30/2025 (13) 08/31/2025 (17) 09/01/2025 (167) 09/02/2025 (124) 09/03/2025 (149) 09/04/2025 (112) 09/05/2025 (72) 09/06/2025 (169) 09/07/2025 (162) 09/08/2025 (150) 09/09/2025 (176) 09/10/2025 (194) 09/11/2025 (194) 09/12/2025 (186) 09/13/2025 (207) 09/14/2025 (159) 09/15/2025 (175) 09/16/2025 (198) 09/17/2025 (196) 09/18/2025 (196) 09/19/2025 (207) 09/20/2025 (129) 09/21/2025 (4)