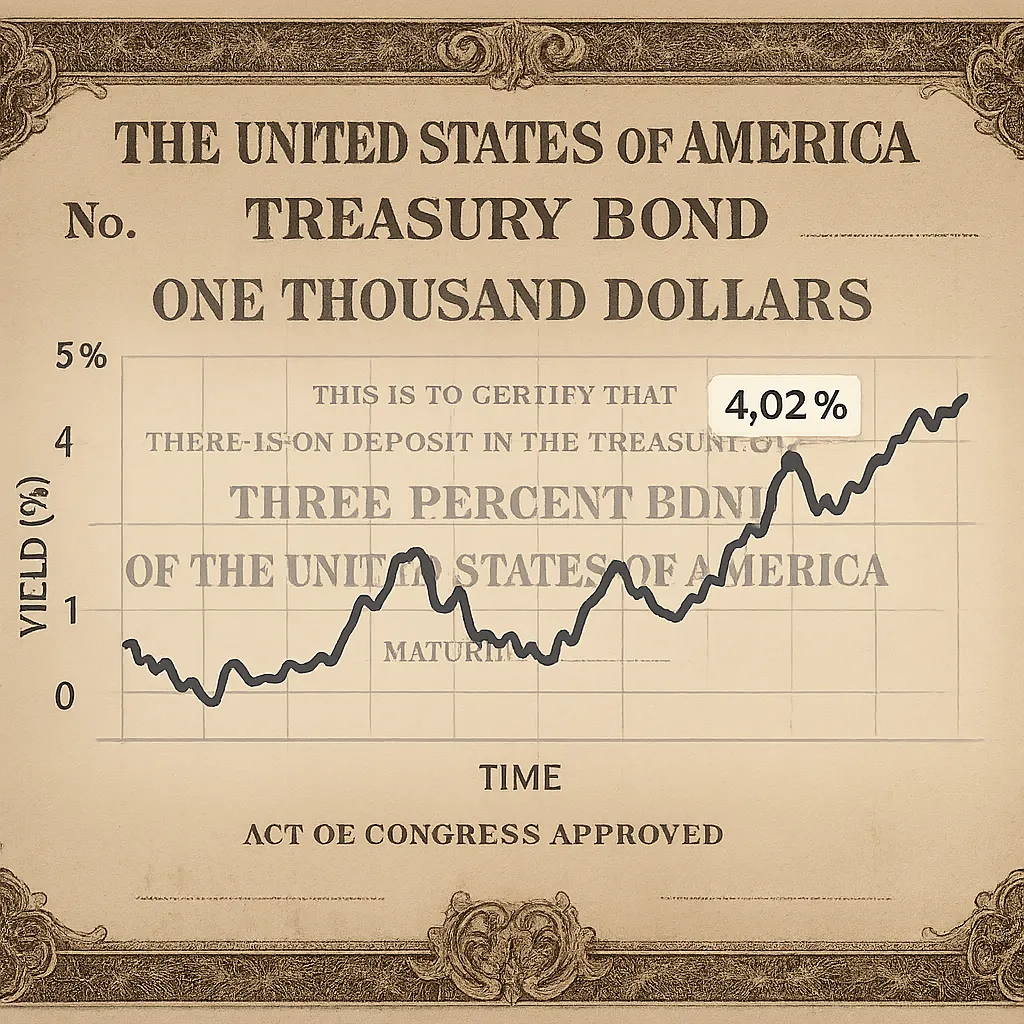

US 10-Year Treasury Yield Eases to 4.02% as Markets Await Fed Decision

Lead: The yield on the US 10-year Treasury note dipped to 4.02% on Wednesday, down one basis point from the prior session, as investors braced for the Federal Reserve’s policy announcement.

Nut Graf: The modest pullback extends a recent slide in longer-term borrowing costs and underscores growing market expectations for a quarter-point rate cut at today’s Fed meeting.

Market Reaction

- Current Yield: 4.02%, down 0.01 percentage point from Tuesday.

- Trend: The 10-year rate has fallen 0.32 percentage point over the past month, though it remains 32 basis points above its level a year ago.

Fed Outlook

- Traders are fully pricing in a 25-basis-point reduction in the federal funds rate later today, with roughly 67 basis points of easing expected by year-end.

- Attention centers on the Fed’s Summary of Economic Projections and “dot plot,” which will signal policymakers’ rate path for the next 12 months.

Economic Backdrop

- Labor Market: Recent payroll reports show a cooling trend, bolstering the case for looser monetary policy.

- Inflation: Despite softening job growth, inflation remains above the Fed’s 2% target, constraining aggressive rate cuts.

- Consumer Spending: US retail sales rose for a third consecutive month in August, reflecting resilient consumer demand ahead of the Fed’s policy decision.

Outlook for Investors

- With longer-term yields near five-month lows, bond investors are weighing the interplay between economic growth prospects and forthcoming Fed actions.

- Market participants will also monitor this week’s housing-sector data-building permits, housing starts-and Thursday’s initial jobless claims for further clues on the economy’s momentum.

Subheadings help readers scan key developments in the US Treasury market and contextualize the Fed’s decision impact on bond yields.

Categories

Autos and vehicles Beauty and fashion Business and finance Climate Entertainment Food and drink Games Health Hobbies and leisure Jobs and education Law and government Other Politics Science Shopping Sports Technology Travel and transportationRecent Posts

Gunman Arrested After Country Club Wedding Shooting in Nashua

Trump, Vance Honor Charlie Kirk at Massive Arizona Funeral

DOJ Closes Bribery Probe into Border Czar Tom Homan

Bad Bunny Concludes Puerto Rico Residency with Star-Studded Amazon Livestream

Multiple Shot, Including One Fatality, at Sky Meadow Country Club

Bad Bunny Delivers Historic “Una Más” Livestream Finale from Puerto Rico

‘28 Years Later’ Arrives on Netflix, Three Months After Theatrical Debut

Cyberattack Snarls Check-In Systems at Major European Airports

Premier League Sees Upsets as Liverpool Edges Everton

Chelsea’s Adarabioyo Drafted In After Sanchez Sent Off at Old Trafford

Superman Premieres on HBO Linear Tonight as Streaming Hit

Southern Skies to Darken: Partial Solar Eclipse Looms Tomorrow

Venus’s Square with Uranus Fuels Independence in Today’s Horoscopes

Dublin Airport’s Terminal 2 Evacuated and Reopened After Security Alert

Tell me what happened today 09/20/2025: “tcu” and write it in news format in English.

Clemson University Dismisses Three Employees After Free Speech Controversy

Braun Strowman Unveils USA Network Series and Horror Sequel Role

Noem Launches National ICE Initiative via Social Media

Binance Implements Margin and Leverage Adjustments on September 20, 2025

Spurs Salvage Late Draw at Brighton

Tags

Archives

08/19/2025 (3) 08/20/2025 (40) 08/21/2025 (27) 08/22/2025 (22) 08/23/2025 (4) 08/24/2025 (21) 08/25/2025 (30) 08/26/2025 (24) 08/27/2025 (29) 08/28/2025 (16) 08/29/2025 (9) 08/30/2025 (13) 08/31/2025 (17) 09/01/2025 (167) 09/02/2025 (124) 09/03/2025 (149) 09/04/2025 (112) 09/05/2025 (72) 09/06/2025 (169) 09/07/2025 (162) 09/08/2025 (150) 09/09/2025 (176) 09/10/2025 (194) 09/11/2025 (194) 09/12/2025 (186) 09/13/2025 (207) 09/14/2025 (159) 09/15/2025 (175) 09/16/2025 (198) 09/17/2025 (196) 09/18/2025 (196) 09/19/2025 (207) 09/20/2025 (129) 09/21/2025 (4)