Amex Unveils Refreshed Platinum Card with $895 Fee and Expanded Perks

American Express rolled out its first major overhaul of the Platinum Card in four years on September 18, 2025, hiking the annual fee to $895 and introducing enhanced travel, dining and lifestyle benefits to deliver over $3,500 in annual value for cardholders.

Why It Matters This refresh, the largest since 2021, comes as premium credit cards face rising fees and intensifying competition for affluent and younger spenders. Amex aims to reinforce the Platinum Card’s status-symbol appeal and ensure the benefits justify the steeper cost amid evolving consumer expectations.

Fee Increase and Effective Dates

- Annual fee rises from $695 to $895 for new applicants effective immediately and for renewals on or after January 2, 2026 (consumer) and December 2, 2025 (business).

- Authorized user fee remains unchanged at $195.

Expanded Consumer Benefits

- Dining Credit: Up to $400 annually on Resy reservations-$100 per quarter.

- Hotel Credit: Up to $600 annually for prepaid bookings through Amex Fine Hotels & Resorts or The Hotel Collection ($300 biannually).

- Wellness & Lifestyle: New statement credits include $300 digital entertainment, $300 at Lululemon and $200 for Oura wellness purchases.

- App Enhancements: Redesigned Amex mobile app simplifies benefit enrollment, tracks credits and facilitates travel planning.

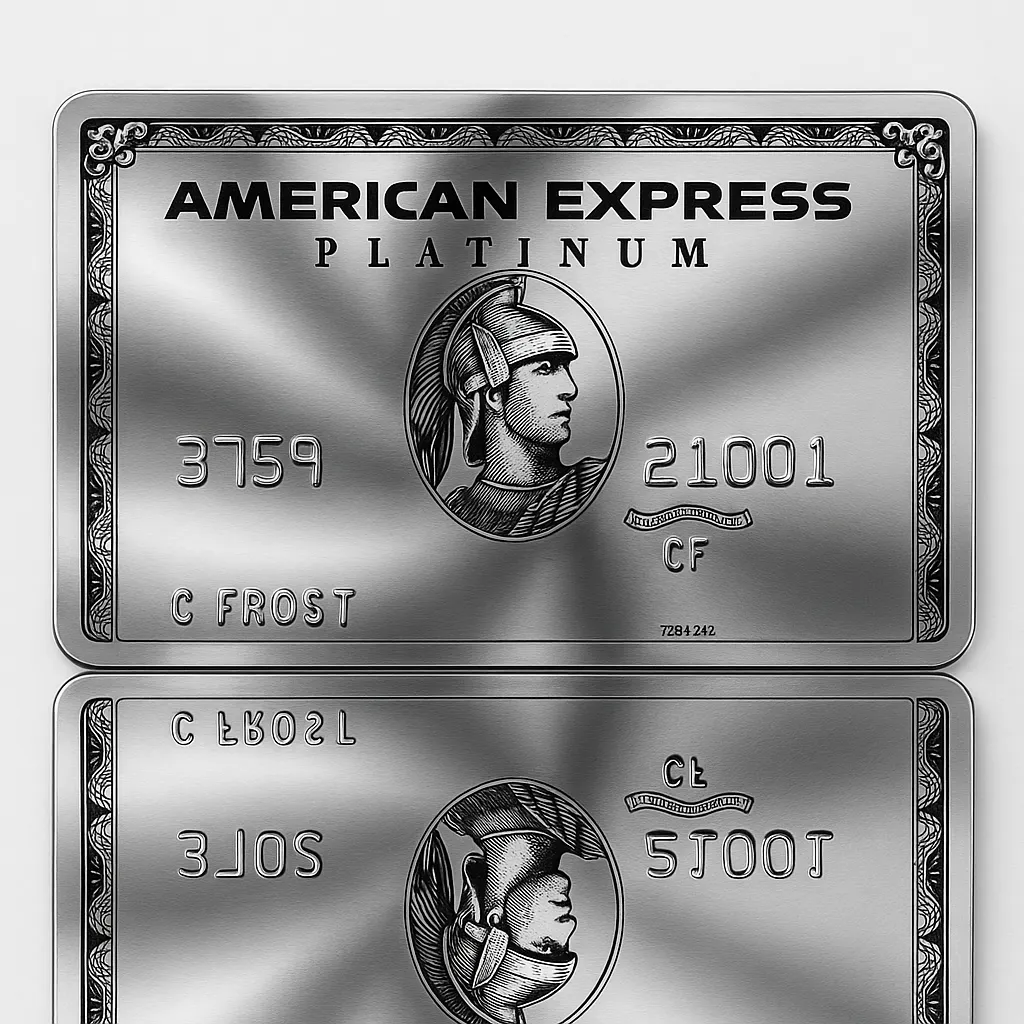

- Limited-Edition Design: A mirrored metal card available for six months, subject to supply.

Business Platinum Updates

- Matches consumer fee and benefit structure: $895 annual fee with $3,500 in business-focused credits, including new Dell and Adobe statement credits and enhanced travel perks.

Competitive Landscape

The refresh underscores an “arms race” among premium cards, following recent upgrades at Chase Sapphire Reserve ($795 fee) and Citibank’s Strata Elite ($595 fee). Amex targets millennials and Gen Z, which now account for over 35% of U.S. consumer spending, to sustain loyalty in the lucrative high-end segment.

Consumer and Industry Reaction

Industry analysts say the boosted credits, particularly for hotels and dining, can easily offset the $200 fee increase for frequent travelers and lifestyle-focused cardholders. American Express executives expect strong uptake given robust demand for premium travel and lifestyle products.

Categories

Autos and vehicles Beauty and fashion Business and finance Climate Entertainment Food and drink Games Health Hobbies and leisure Jobs and education Law and government Other Politics Science Shopping Sports Technology Travel and transportationRecent Posts

Tags

Archives

08/19/2025 (3) 08/20/2025 (40) 08/21/2025 (27) 08/22/2025 (22) 08/23/2025 (4) 08/24/2025 (21) 08/25/2025 (30) 08/26/2025 (24) 08/27/2025 (29) 08/28/2025 (16) 08/29/2025 (9) 08/30/2025 (13) 08/31/2025 (17) 09/01/2025 (167) 09/02/2025 (124) 09/03/2025 (149) 09/04/2025 (112) 09/05/2025 (72) 09/06/2025 (169) 09/07/2025 (162) 09/08/2025 (150) 09/09/2025 (176) 09/10/2025 (194) 09/11/2025 (194) 09/12/2025 (186) 09/13/2025 (207) 09/14/2025 (159) 09/15/2025 (175) 09/16/2025 (198) 09/17/2025 (196) 09/18/2025 (196) 09/19/2025 (207) 09/20/2025 (129) 09/21/2025 (4)