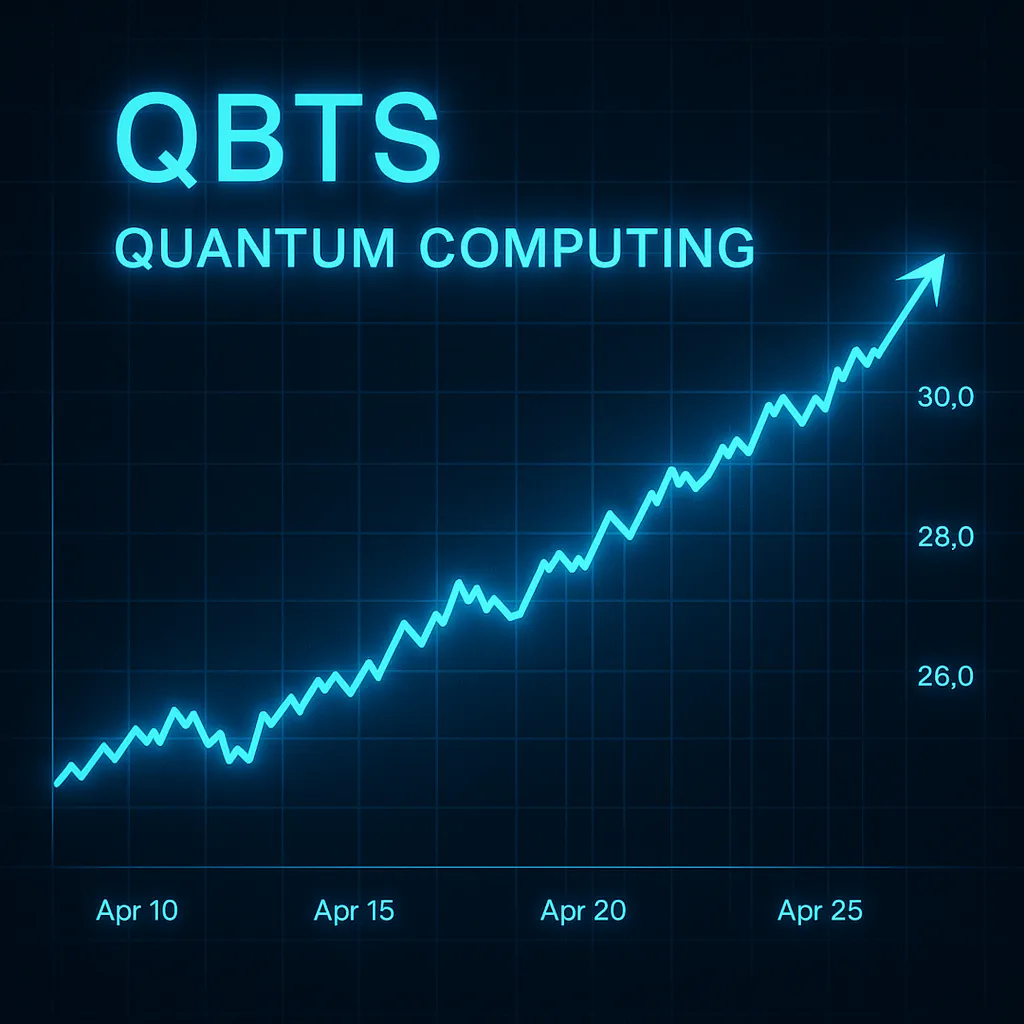

QBTS Shares Pull Back After Recent Rally

D-Wave Quantum Inc. (NYSE: QBTS) stock slid in early trading on Friday, September 19, dipping 2.46% to $23.43 as profit-taking weighed on the quantum computing leader. While still up sharply year-to-date, QBTS ranked among the session’s top pre-market decliners, highlighting a brief pause after this week’s record highs.

A modest reversal follows QBTS’s 19% jump on Thursday, when the company’s inaugural Qubits Japan 2025 conference spurred a surge in Asia-Pacific bookings and investor enthusiasm.

Market Reaction

- Pre-Market Range: $23.13-$23.49

- Previous Close: $24.02

- Pre-Market Change: -$0.59 (-2.46%)

Sector Context Despite today’s pullback, quantum computing stocks remain in focus after a multi-day rally. Thursday’s Qubits Japan event vaulted QBTS to an all-time high, part of broader gains for peers IonQ and Rigetti Computing. Analysts caution that short-term volatility may intensify after explosive moves, suggesting a consolidation phase could precede further upside.

Outlook Traders eye key support levels near $23.00, while resistances around $24.50 may cap upside in the near term. Long-term investors remain bullish on QBTS’s growth trajectory, though market watchers advise disciplined entries amid sharp swings in this emerging sector.

Categories

Autos and vehicles Beauty and fashion Business and finance Climate Entertainment Food and drink Games Health Hobbies and leisure Jobs and education Law and government Other Politics Science Shopping Sports Technology Travel and transportationRecent Posts

Tags

Archives

08/19/2025 (3) 08/20/2025 (40) 08/21/2025 (27) 08/22/2025 (22) 08/23/2025 (4) 08/24/2025 (21) 08/25/2025 (30) 08/26/2025 (24) 08/27/2025 (29) 08/28/2025 (16) 08/29/2025 (9) 08/30/2025 (13) 08/31/2025 (17) 09/01/2025 (167) 09/02/2025 (124) 09/03/2025 (149) 09/04/2025 (112) 09/05/2025 (72) 09/06/2025 (169) 09/07/2025 (162) 09/08/2025 (150) 09/09/2025 (176) 09/10/2025 (194) 09/11/2025 (194) 09/12/2025 (186) 09/13/2025 (207) 09/14/2025 (159) 09/15/2025 (175) 09/16/2025 (198) 09/17/2025 (196) 09/18/2025 (196) 09/19/2025 (207) 09/20/2025 (129) 09/21/2025 (4)